Pag IBIG housing loan 2023: form, requirements, calculator, application

Home Development Mutual Fund (HDMF), popularly known as the Pag IBIG housing loan fund, is a government-owned agency. The agency is under the Human Settlements and Urban Development department and is responsible for administering the national savings program and affordable house financing.

Source: UGC

The beneficiaries of this agency range from Filipino locals, foreign employees, and voluntary self-employed individuals. But what are the minimum requirements and process for application?

What is Pag IBIG housing loan?

This is a government corporation which you can obtain a housing loan from. It is also an excellent alternative to banks as it offers a higher savings rate over time. The fund was established in 1978 to serve the following basic needs of Filipinos:

- National/government savings platform

- Shelter and affordable housing financing

How to avail Pag IBIG housing loan

You should start by applying for the appropriate financing option according to your needs. Submit all the required documents. If approved, collect your cheque at the disbursement office.

You should not have any outstanding housing loans. However, you might be allowed to avail of another credit if you meet the set criteria discussed in this write-up. If you have a multi-purpose or calamity loan, you cannot avail of a Pag IBIG housing loan until you fully pay the balance.

Pag IBIG loan requirements

There are two sets of prerequisites - one during the loan application and another upon or before the credit release. You will need the following when applying for housing financing from the agency:

Fees

- A non-refundable processing fee of P1,000.

- An appraisal fee of P2,000.

- For every re-evaluation and re-filling of your request, you will need P1,000.

Documents

- A completed Pag IBIG loan form with your recent ID photo.

- Vicinity map and a sketch of the house/property in question.

- Copies of tax declarations and real estate tax receipts.

- Latest true and certified copy of the Transfer Certificate of Title (TCT).

The employed should bring any of the following to prove their incomes:

- Certificate of Employment and Compensation (CEC) should show your gross income, monetary benefits, and allowances.

- Your income tax return for the previous year.

Self-employed need:

- Certificate of Employment and Compensation (CEC). It can be in the form of a signed document or supported by your employer’s ID or passport. A CEC letter written by your company is accepted too.

- Income tax returns from your host country. It should be translated into English if written in foreign languages.

You will need a photocopy of your valid ID, your spouse, seller, owner of the title, and co-borrower, if applicable. Here are the accepted IDs by the agency:

- Passport (It can either be Philippine or foreign)

- Company ID

- Professional Regulation Commission (PRC) ID

- Government Service Insurance System (GSIS) eCard

- DL

- Social Security System (SSS) ID

- Government Office and GOCC Identity Cards such as AFP ID or Pag IBIG loyalty card

- Integrated Bar of the Philippines (IBP) I

Source: UGC

Pag IBIG housing loan requirements for house construction

After you have applied, you will need the following before accessing your financing so that you can start building or buying your property.

Fees

- P2,000 upon taking out of the loan.

There are also other additional fees where applicable:

- P1,000 for every inspection (above four assessments).

- A handling fee of P2,000 for any additional payment issued in regard to spilt loan proceeds.

Documents

The following documents are mandatory:

- TCT or CCT in your name with a mortgage annotation favouring Pag IBIG.

- Updated tax declaration and real estate receipts.

- Disclosure statement on the transaction.

- Accomplished promissory note.

Other additional requirements for Pag IBIG housing loan eligibility include the following where applicable:

- Surety bond.

- Collection servicing agreement. It should have the authority to deduct loan amortization as well as post-dated checks

For buying many residential units, you will need:

- Deed of absolute sale with an original rd signatory.

- Occupancy permit if the unit is new.

For lot purchase with the construction of the house:

- Deed of absolute sale duly with an original RD stamp.

- Occupancy permit.

- The approved building, electrical and sanitary permits.

Pag IBIG housing loan interest rates

There are two types of financing:

- Affordable housing loan program.

- Regular housing loan program.

For affordable housing credit type, you will be charged the following based on your income:

- If you have a monthly income of below P15,000, you can access a loan of up to the socialized housing ceiling of 3% per annum.

- Individuals earning more than P14,000 and less than P17 500 can be issued with financing at a rate of 6.5% rate.

The above interests might change from time to time, subject to management approval. Those seeking more considerable limits of up to P6,000,000 falls under the regular plan. Their rates are generally based on the repricing period you choose under a full risk-based pricing framework.

Pag IBIG housing loan computation

To determine the amount of money you can borrow from the regular Pag IBIG considers the following:

- The amount you need to fully complete/buy the house.

- The actual loan you have asked for.

- Loan-to-appraised value ratio.

- Your current income will suggest your repayment capacity.

Loan limits also depend on your monthly savings contributions. The higher you save, the greater your credit amount.

What is the repricing period for the Pag IBIG housing loan?

This is a duration for which the indicated interests will apply. After the said time, the rates will be adjusted according to economic factors to either go up or down. For instance, if you choose their 1-year fixed price option, you are guaranteed to pay 5.750% in the first year.

Once the period is over, rates will no longer be constant. They will fluctuate up or down depending on some factors. You can choose a repricing period of 1 to 30 years to avoid future fluctuations.

Source: UGC

How to apply for Pag IBIG housing loan

The first step is knowing the purpose of your loan. Choose the appropriate product as per your specification. Have all the required documents and fees upon application and before credit release.

Next, you need to submit the documents to Pag IBIG. You should then wait for the approval. Finally, claim the amount and start your monthly amortization.

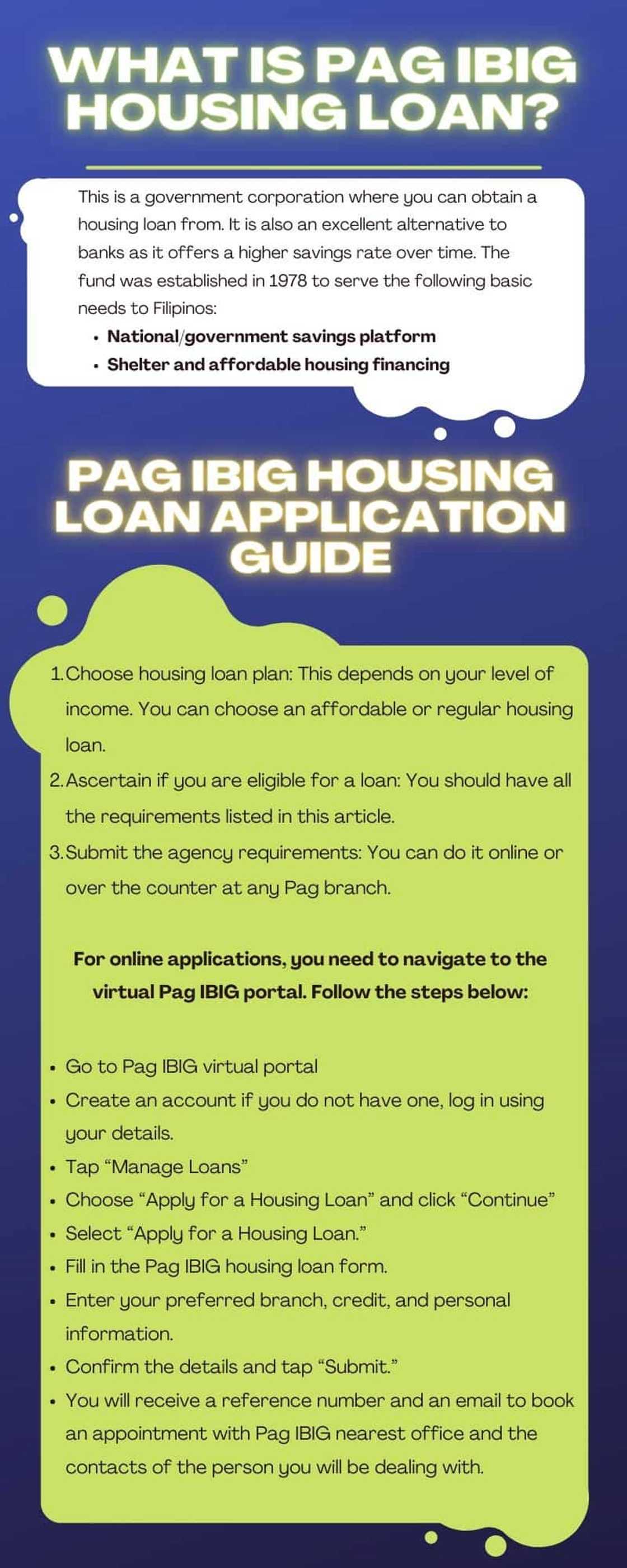

Pag IBIG housing loan application guide

Follow the steps below to apply for housing financing:

1. Choose a housing loan plan

This depends on your level of income. You can choose an affordable or regular housing loan. You can easily determine the amount you can borrow through the Pag IBIG housing loan calculator.

The Pag-IBIG salary loan calculator will estimate how much you can borrow based on your loan amount, repayment period and fixed pricing period. You should note that the calculator should only serve as a guide. The actual loanable amount will be evaluated by Pag IBIG’s staff.

2. Ascertain if you are eligible for a loan

You should have all the requirements listed in this article.

3. Submit the agency requirements

You can do it online or over the counter at any Pag branch. For Pag IBIG online registration, you need to navigate to the virtual Pag IBIG portal. Follow the steps below:

- Go to Pag IBIG virtual portal.

- Create an account if you do not have one.

- Log in using your details.

- Tap “Manage Loans.”

- Choose “Apply for a Housing Loan.”

- Click “Continue.”

- Assuming that this is the first time you are making the application, select “Apply for a Housing Loan.” If not, then you should go to the "Reschedule Housing Loan Application Appointment.”

- Fill in the Pag IBIG housing loan form.

- Another application questionnaire will appear. Enter your preferred branch, credit, and personal information.

- Once done, confirm the details and tap “Submit.”

- You will receive a reference number and an email to book an appointment with Pag IBIG's nearest office and the contacts of the person you will be dealing with.

Alternatively, you could visit any regional office near you for an over-the-counter application. You will need to:

- Submit copies of your application form and all other documents.

- Pay processing and appraisal fees.

- Submit the receipt to the Members’ Services Support department.

Source: UGC

4. Wait for approval

Pag IBIG housing loan verification takes an average of 17 days. In case your request is turned down, you will receive a Notice of Disapproval. If it was accepted, the agency will call you to pick up your Notice of Approval (NOA) and Letter of Guaranty (LOG)

5. Sign loan documents

After receiving the LOG and NOA, you should go to the Members' Services department. Discuss credit obligations with customer cares. Make sure you fully understand all the terms in the following documents:

- Promissory note

- Disclosure statement on the credit transaction

- Loan and mortgage agreement

Affix your signature to the Pag-IBIG loan form 2023 only if you have fully understood them.

6. Complete the NOA prerequisites

Submit it within 90 days of issuance else you won’t access the credit.

7. Claim loan proceeds

If you followed the procedure to the letter, you should now have your PagIBIG house loan.

Where to pay Pag IBIG housing loan

Here are the payment options available for you:

- Post-dated checks: Submit 12 post-dated cheques to Pag IBIG fund upon a loan release.

- Salary deduction: Submit an authority to deduct the document to the billing division.

- Verified collection partners.

- Auto debit bank arrangement.

- Payments via an accredited developer with a collection service agreement from the Pag IBIG agency.

Pag IBIG salary loan online

Pag IBIG also issues short-term loans to its members to help them out with any financial needs. A member can borrow up to 80% of his/her savings. The loan is processed in less than 2 days.

There are two categories offered here:

Multi-purpose loan

This loan can be taken by any member for various reasons. The following are the requirements you should meet before the loan is processed:

- Fill in a Multi-Purpose Application form.

- Attach one copy of your ID.

- Since you are salaried, you need to attach your proof of income.

- Self-employed people can also apply if they can prove they get a substantial income every month.

- Photocopy of your payroll or disbursement card.

To apply, just submit an accomplished Multi-Purpose Loan form and all the supporting documents. You will then be given an STL Acknowledgement Receipt. Your loan should be disbursed on the scheduled date.

Calamity loan

This credit service is only available to people who live in areas declared under a state of calamity. Such areas might be affected by disasters such as floods and so forth.

This loan will provide immediate assistance to such people at an interest rate of 5.95% per year. The amount issued is repayable in 24 months.

To apply you need the following:

- Fill in the Pag IBIG calamity loan application form.

- Attach a valid ID accepted by the agency.

- Include your proof of income.

- You will also need a certificate from Municipal Offices if your property was damaged.

- Business owners need certification from the Municipal Mayor or Market Vendors Association attesting to what type of business they do.

- If any of your family members are sick, then you need a Medical Certificate from the attending doctor stating that the disease affecting him/her is a result of a calamity.

- For releasing the loan, you need a Payroll or disbursement account.

Once you submit your Calamity loan application form, you will be given an STL acknowledgement receipt. Your loan will be disbursed on the scheduled date.

Advantages and disadvantages of Pag IBIG housing loan

The following are the pros and cons of this type of financing:

- Qualifications: Minimum wage earners are accepted, unlike banks, which are after profits. Hence, they do not issue credit to anyone who cannot prove her ability to pay off.

- Loan amount: You can get a loan of as low as P 750,000 and as high as P 6,000,000 depending on your income.

- Interest rates: Pag IBIG housing loan rates are lower compared to those of banks.

- Loan repayment period: You should pay it within 30 years. This is by far longer than what most financers demand.

Pag IBIG only con is that you need to be a member and have some savings before you can obtain any financing product. In contrast, for banks, you only need to prove that you are employed, have a steady income, and can repay the credit. You don’t have to be a member.

Pag IBIG number

Use the following Pag IBIG hotline to reach out to customer care representatives:

- Head office location: Petron Mega Plaza, Puyat Avenue, Makati City

- Phone number: (02) 8-422-3000

- Mailing address for members relation: 2nd Flr, JELP Business Solution Center, 409 Shaw Boulevard, Brgy. Addition Hills, Mandaluyong City, Philippines

- Hotline: 8-724-4244

- Email: contactus@pagibigfund.gov.ph

- Website: pagibigfund.gov.ph

How to get Pag IBIG ID

To obtain a Pag-IBIG ID, also known as the Pag-IBIG Loyalty Card Plus, ensure that you are a registered member of the Pag-IBIG Fund. If you're not yet a member, you can visit the nearest Pag-IBIG branch or their website to register and obtain your Pag-IBIG MID number.

Pag IBIG housing loan is one of the common financing options taken by Filipinos who wish to own a house. Their rates are low and the limit higher to accommodate the average-income workers.

Kami.com.ph gave a detailed procedure on how to check Pag IBIG contribution. Pag-IBIG Fund has helped many Filipinos to apply for flexible and affordable housing loans.

It is always good to know about the services provided by the government if you are an adult looking to secure your home. Also, it is a great idea to regularly check your contribution and do a Pag IBIG online verification upon application to certify the accuracy of your data.

Source: KAMI.com.gh