SSS PRN: Number, registration, application, procedure, log in

The Social Security System (SSS) is the insurance scheme through which Filipinos make health and retirement contributions. Self-employed and employed Filipinos make contributions to this scheme. The government launched the PRN in January 2018. Since then, SSS PRN has become a mandatory requirement for all members.

Source: UGC

The Filipino government launched the reference number in line with the implementation of the real-time posting of contribution payments project, also referred to as the RPTC project. It entails the instant validation and acknowledgment of member contributions between the Social Security System and the payment channel.

What is the meaning of PRN in SSS?

An SSS PRN number means the Social Security System Payment Reference Number. It is a unique number an SSS member uses when remitting their contributions. You must generate a new PRN every time you pay your SSS Contribution (monthly or quarterly).

You can discover the SSS PRN registration procedure, how to get a SSS PRN number, and how to pay your contributions via GCash below:

Read also

GMA Network, naglabas ng statement ukol sa ‘Eat Bulaga’: “We are saddened by today's unexpected turn of events”

The SSS online registration process

The social security system protects members and their families against the hazards of disability, maternity, sickness, old age, death, and other contingencies resulting in a financial burden or loss of income. Below is a detailed explanation of the SSS online registration procedure:

- Go to the SSS website.

Source: UGC

- Tick the checkbox “I’m not a robot.”

- Click “Member.”

- Click “Register in My.SSS”

- Please read the reminders and certify that you have understood them.

- Click “Proceed.”

- Enter your details (CRN/SS number, email, address, and preferred user ID).

- Enter your complete name and date of birth.

- Click "Ok" to confirm your age or "retry" to re-enter the correct date of birth.

- Enter your mailing address and/or foreign mailing address.

- Select one registration preference from the dropdown list.

- Tick the checkbox “I’m not a robot.”

- Click “I accept the terms of service.”

- Click “Submit.”

- Review your entered information.

- Click "Confirm" if all information is correct.

- Click "Cancel" to edit entered information.

- Click "Ok" and check your email for the password setup.

- Upon submission, click "ok" and check your email for the password setup.

- Tap "click here" to be directed to the set password page.

- Enter the last six digits of your CRN/SS number.

- Click "Submit."

- Enter your preferred password.

- Re-enter your preferred password, then click “Submit.”

- After successful password setup, you will be directed to your My.SSS member account.

Source: UGC

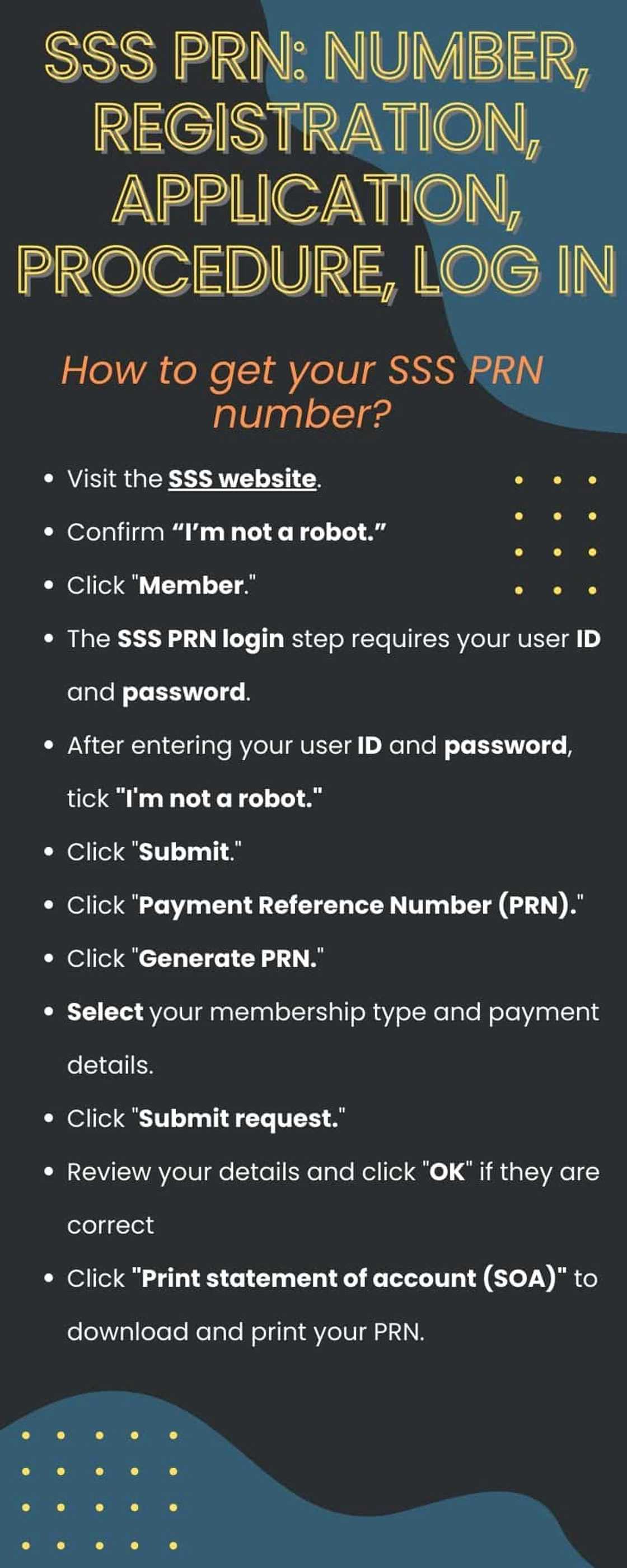

How to get your SSS PRN number?

SSS members pay their contributions through various SSS Payment Partners, including Bayad Center, Paymaya, GCash, and Banks. The instant posting of payments ensures that members can see the status of the latest payment they have made and all payments made.

How to get a PRN number SSS online

The SSS has made it mandatory for all employers and members to use the Payment Reference Number (PRN) when paying SSS loans. After completing the SSS PRN online application process, here is how to generate PRN SSS via the SSS website:

- Visit the SSS website.

- Confirm “I’m not a robot.”

- Click "Member."

- The SSS PRN login step requires your user ID and password.

- After entering your user ID and password, tick "I'm not a robot."

- Click "Submit."

- Click "Payment Reference Number (PRN)."

- Click "Generate PRN."

- Select your membership type and payment details.

- Click "Submit request."

- Review your details and click "OK" if they are correct

- Click "Print statement of account (SOA)" to download and print your PRN.

Read also

Julie Anne San Jose, video ng pagkanta niya ng Japanese version ng Voltes V theme, viral; Netizens, napa-wow

Source: UGC

Can I generate PRN in SSS app?

The SSS app allows you to view the status and analysis of total contributions and know the locations of SSS branches on a map. Below is a detailed guide about how to generate PRN SSS via the SSS app:

- Download and install the SSS App on your smartphone.

- Log into their SSS Mobile App using your existing My.SSS account's user ID and password.

- If they don't have an account yet, create a My.SSS account on the SSS Mobile App by selecting "Register" at the apps' sidebar.

- After signing in, tap "Generate PRN/SOA" on the app's home screen.

- Fill in the necessary details and submit them.

- Your SSS PRN number will appear on the screen.

- You can view, screenshot, or download your SSS PRN as a PDF file for future use.

- You can also view, download and edit their Statement of Account (SOA), particularly the amount of contribution payment and applicable payment period.

Read also

Vic Sotto, no comment sa tanong kung mas gusto niyang sa GMA pa rin ang “Eat Bulaga”: “Di tayo magko-comment”

SSS member registration process using a helpline

You can get the reference number using these SSS PRN contacts:

- SSS PRN hotline: (02) 920-6446 to 55/917-7777 or 1-800-10-2255-777

The helpline operates 24 hours between Mondays and Fridays.

How do I get my PRN through email?

You can send your email to PRNHelpLine@sss.gov.ph or onlineserviceassistance@sss.gov.ph to get your PRN.

Source: UGC

How can I get my SSS PRN number through SMS?

Here is how to generate PRN SSS via a text message. First, you should send a text message to 2600 in this format:

- SSS REG <10 DIGIT SSS number> <date of birth (MM/DD/YYYY)>

You will receive a reply confirming your registration to the text service and a four-digit PIN. Use the PIN to get your personal reference number by sending a text message to 2600 in the following format:

- SSS PRN <10-digit SSS number> <PIN> <date of birth (MM/DD/YYYY)>

Note that text message charges of PHP 2.5 apply to Globe network and Smart mobile subscribers. Sun Cellular subscribers are charged PHP 2.

The SSS PRN registration procedure at an e-Centre or SSS counter

You can get your PRN by visiting the nearest Social Security System branch. The staff at the SSS counter will request your SS ID (Social Security System ID) or UMID card. Alternatively, you can provide your date of birth if you have not carried any of these documents.

Source: UGC

What are the types of SSS?

An SSS member can be a private sector worker or an individual member (self-employed, voluntary, OFW, non-working spouse). There are two types of coverage under the regular SSS Program:

Compulsory Coverage is for:

- Employer (Business or Household Employer)

- Employee

- Self-Employed

- Househelper or Kasambahay

- Overseas Filipino Workers (OFW) (land-based and sea-based, except for Filipino permanent migrants, including Filipino immigrants, permanent residents, and naturalized citizens of their host countries, who may be covered voluntarily).

Voluntary Coverage is for:

- Non-Working Spouse (NWS)

- Separated Members

Source: UGC

How to create an SSS Account using an SSS Employer ID Number?

Read also

Pia Wurtzbach at Jeremy Jauncey, nakatanggap ng sangkaterbang pagbati mula sa maraming celebrities

An individual or employer can become an SSS member by registering on the SSS portal. Below is a simple guide on how to register online in SSS My.SSS using Employer ID Number or Household Employer ID Number:

- Go to the SSS website.

- Confirm the checkbox “I’m not a robot.”

- Click "Not yet registered in My.SSS."

- Read the reminders and tick to certify you have understood the reminders.

- Click "Proceed."

- Fill in the required details and click "Ok" to move to the next page.

- Enter your details, accept the terms and conditions, answer the captcha, tick the "I'm not a robot" checkbox, and click "Submit."

- You will do the step above on multiple pages until you reach the confirmation page.

- Review the details on the confirmation page and click "Confirm" if correct.

- Click "Ok" on the pop-up page above your screen.

- You will see a message confirming you have registered your SSS account.

- Check your email after about ten seconds.

- Read the email and click a link to a page for resetting your SSS account password.

- Enter your new password, confirm it, and click "Submit."

- Click "Set up a security question."

- Choose a question and type your answer.

- Enter your password, tick the checkbox "I'm not a robot," and click "Confirm."

Source: UGC

How to remove an employee from the SSS PRN portal?

An SS member separated from employment or ceased to be a self-employed/overseas Filipino worker/non-working spouse may continue paying SSS contributions using the previously assigned SS number through Contributions Payment Return (SS Form RS-5). You can also remove an employee from your employer's SSS portal. To remove an employee in SSS online, please follow these steps:

- Go to the SSS website.

- Answer the captcha and tick the checkbox "I'm not a robot."

- Click "Submit" and choose "Employer" on the portals page.

- Log into your SSS online employer account using your username and password.

- Click "Payment Reference Number (PRN)."

- Click "Cancel" in front of the employee's PRN.

- Click "Yes" to confirm the cancellation.

- Input your reasons for canceling the employee's PRN.

- Click "Submit."

How do I add an employee to my SSS portal?

Employers have a share in the monthly contribution. The employer must withhold a certain portion of the employee's salary and pay it to SSS. You can add a new employee to SSS by filling and submitting an Employment Report Form (R-1A form) online through your Employer SSS portal. To add an employee in SSS online:

- Go to the SSS website.

- Tick the checkbox "I'm not a robot."

- Click "Submit" and choose "Employer" on the portals page.

- Log into your SSS online employer account using your username and password.

- Click "Submit Employee Report."

- Enter the employee's details.

- Click "Add," and you will see the employee's details below.

- Click the pencil icon to edit the details, and click "update" to edit the details.

- Click "Add" when you are done editing the details.

- Read the disclaimer and click "Print."

- Tick in the check boxes of the employee's details.

- Click "Submit."

- Click "Ok" in the pop-up message above your screen.

- You will see a message that you have successfully reported your employee report.

Source: UGC

How to generate PRN Contributions for employers?

Employers in the Philippines can generate and modify their electronic collection lists on the PRN SSS portal. Here are the steps for them to follow:

- Visit the SSS website.

- Tick the checkbox "I'm not a robot."

- Click "Submit" and choose "Employer" on the portals page.

- Log into your SSS online employer account using your username and password.

- Click "Payment Reference Number (PRN)."

- Click "Select Records from the SSS List."

- Click "Add record."

- Add your record and click "Add record."

- Click "Save Record."

- Click "Confirm List."

- Tick the checkbox that shows you agree with the Contributions Statement.

- Click "Submit."

- Click "Prepare Collection List."

- Click "Ok."

- Click "Download."

Where to pay SSS contribution

Nearly every working Filipino in the private sector contributes monthly to the SSS. An SSS PRN payment can be made through the following channels:

SSS counters

You can pay your contributions at the nearest SSS branches. Before making your payment, ensure the branch has the relevant SSS PRN payment form and automated counter that processes your type of contribution.

Read also

Pokwang, muling nagpasaring sa social media: “When you see the father of your children downgraded”

Banks

Some of the SSS-accredited banks are:

- Asia United Bank

- Bank of Commerce

- Philippine Business Bank

- Wealth Development Bank

- Union Bank of the Philippines

Source: UGC

Non-banks

They include:

- GCash

- PayMaya

- Bayad Center

- SM bills payment counters at The SM Store, hypermarket, supermarket, and Savemore branches

Other SSS payment channels

These SSS payment channels are for overseas Filipino workers:

- AUB

- Bank of Commerce

- iRemit

- Pinot Express

- Sky Freight

- Ventaja

What is SSS PRN in Gcash?

SSS PRN in Gcash is a Social Security System Payment reference number (PRN) that SSS generates. You use the number when paying your contributions or loans through your GCash account.

How to pay your sss contribution through Gcash?

Before paying your SSS contribution through GCash, you should generate your unique PRN (Payment Reference Number). Here is how to pay your SSS PRN online through GCash:

- Log into your GCash app.

- Tap "Bills" on the app's home page.

- Click "Government" under the biller categories.

- Tap "SSS contribution."

- Choose "PRN" as the account type.

- Enter your Payment Reference Number (PRN).

- Enter the amount.

- Choose the Payor Type.

- Enter your email address.

- Tap "Next," review your payment details, and click "Confirm."

- You will receive an in-app receipt, SMS, and email confirming a successful transaction.

Read also

Dating statement ni Cristine Reyes ukol kay Marco Gumabao, binalikan ng netizens: “Ang bata pa ni Marco”

Source: UGC

What is the PRN number of SSS?

PRN is a system-generated Payment Reference Number. The SSS system gives each member a PRN to use when paying their contributions.

Can I pay SSS without PRN?

When paying your contributions, the SSS PRN is a unique number you present to the SSS Payment Partners like Bayad Center, Paymaya, the GCash online payment system, and Banks. The Social Security System can only update your payment records with this number.

Does SSS PRN has an expiration date?

Your SSS PRN expires five days after the due date of a current bill. Attempting to pay using an old PRN can result in wallet deductions or rejected payments.

How to get an SS number online?

SSS is committed to providing its clients with reliable, convenient, and meaningful social security services. Below is how to get an SS number online:

- Visit the SSS website.

- Click "No SSS Number yet? Apply online!"

- Fill all fields of the online form correctly.

- Click "Submit."

- A link shall be sent to the registered email. Click on it to continue with the SS Number application.

- Provide the required information from basic to beneficiaries correctly.

- Before generating an SS Number, review your filled-out registration form.

- Click the "Generate SS Number."

- Wait for the system to display the SS Number.

- You can print the ePersonal Record Form and SS Number Slip.

- You will also receive an email confirmation indicating the generated SS Number, a copy of the SS Number Slip, and further instructions on completing the application.

- Print the ePersonal Record Form, SS Number Slip, and the SS Number Application Confirmation email body sent to you by the SS Number Issuance System.

- Submit your printed records together with the required documents to the nearest SSS Branch:

- If with children, bring a copies of the Birth Certificates.

- If married, bring a copy of your Marriage Contract/Certificate.

- For Non-Working Spouse, your working spouse must sign before their name on the printed ePersonal Record Form.

- The signature will signify that your spouse agrees with your SSS membership.

Source: UGC

Reminders:

- Submission of required documents will convert the registrant's membership status with SSS from "Temporary" to "Permanent."

- Your membership status with SSS shall remain "Temporary" until the required supporting documents have been submitted to the nearest SSS Branch.

- Loans and benefits (subject to qualifying conditions) and UMID card application (with at least one posted contribution) will be allowed only for "Permanent" membership status.

How to track your SSS transaction number?

All Social Security System (SSS) members in the Philippines who have lost, forgotten, or want to track their SSS PRN should call these lines:

- SSS PRN Helpline: 920-6446 to 55

- Toll-free Hotline: 1-800-10-2255-777 (anytime from Mondays to Fridays)

The SSS mobile app purposes

The enhanced SSS mobile app version contains more detailed information like the member’s name, date of birth, contribution payments breakdown, Common Reference Number (CRN), Social Security (SS) Number, contact information, date of coverage, coverage & SS number status, and a Unified Multipurpose Identification (UMID) Savings Account Number. Here are things you can do on the SSS app:

- You can use an SSS app to generate your PRN generation.

- You can use the app to apply for SSS benefits (sickness, maternity, death, retirement, disability, funeral, and unemployment benefits).

It is evident from this article that an SSS PRN is an easy number to generate. Now that you have information on how to get and use it to make pay SSS contributions, you can easily do so the next time the need arises.

Kami.com.ph explained how to get a TIN ID online in 2023. Every taxpayer in the Philippines receives a unique, permanent number called a Tax Identification Number (TIN).

A Taxpayer Identification Number (TIN) is used for tax purposes and other transactions with the Bureau of Internal Revenue (BIR) and other government agencies. The article shares details about the application, registration, and verification processes.

Source: KAMI.com.gh