GCash MasterCard 2023: application, order, withdrawal, fees, tracking

The GCash MasterCard is a virtual prepaid card issued by GCash, a mobile wallet and online payment platform in the Philippines. The GCash MasterCard is easy to use, safe, and convenient for monetary transactions.

Source: Facebook

You can use a GCash MasterCard for online and in-store shopping, cash withdrawals, paying bills, and other financial transactions. You can also link the card to the GCash app or withdraw money from affiliated Bancnet and Card ATMs nationwide.

What is a GCash MasterCard?

A GCash MasterCard is a reloadable monetary prepaid card. You use it to withdraw money from ATMs and pay for online and in-store purchases. The card works as a credit and debit card.

What bank is GCash MasterCard?

The GCash MasterCard was created under the CIMB Bank Philippines and GCash partnership. It is the country's first-ever bank account to be opened and maintained from the GCash app.

The account does not require an initial deposit or maintenance balance. It also has no lock-in period, and moving funds to and from your GCash wallet is easy and fast.

What is the requirement for a GCash Mastercard?

You must have a GCash account and a verified mobile number when applying for a GCash Mastercard.

Learn how to how to request GCash card below.

How to get a GCash MasterCard

You must have a GCash account and a verified mobile number when applying for a GCash Mastercard. You can request a GCash card using these three methods:

- GCash app

- GCash online MasterCard order link

- Partner convenience stores

How to apply for GCash MasterCard online via the GCash app

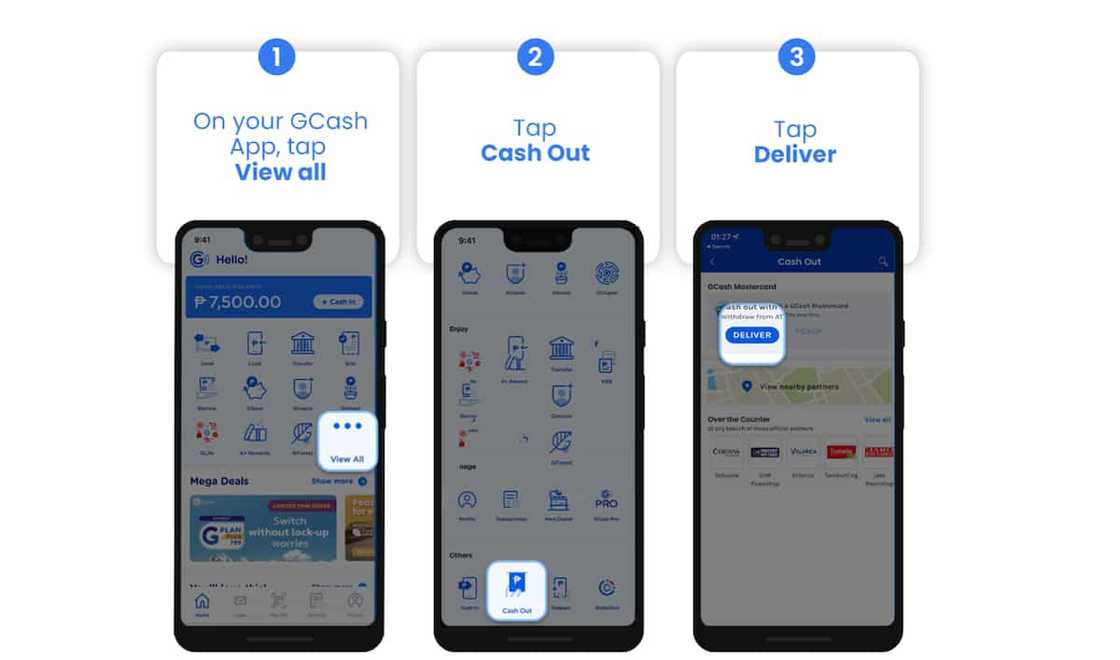

Follow these steps to order the GCash MasterCard via the GCash app:

- Open the GCash app and enter your MPIN to log in.

- Tap "View All" on the GCash homepage.

- Tap "Cash Out" under "Others."

- Click "Deliver" under "GCash Mastercard."

Source: UGC

Source: UGC

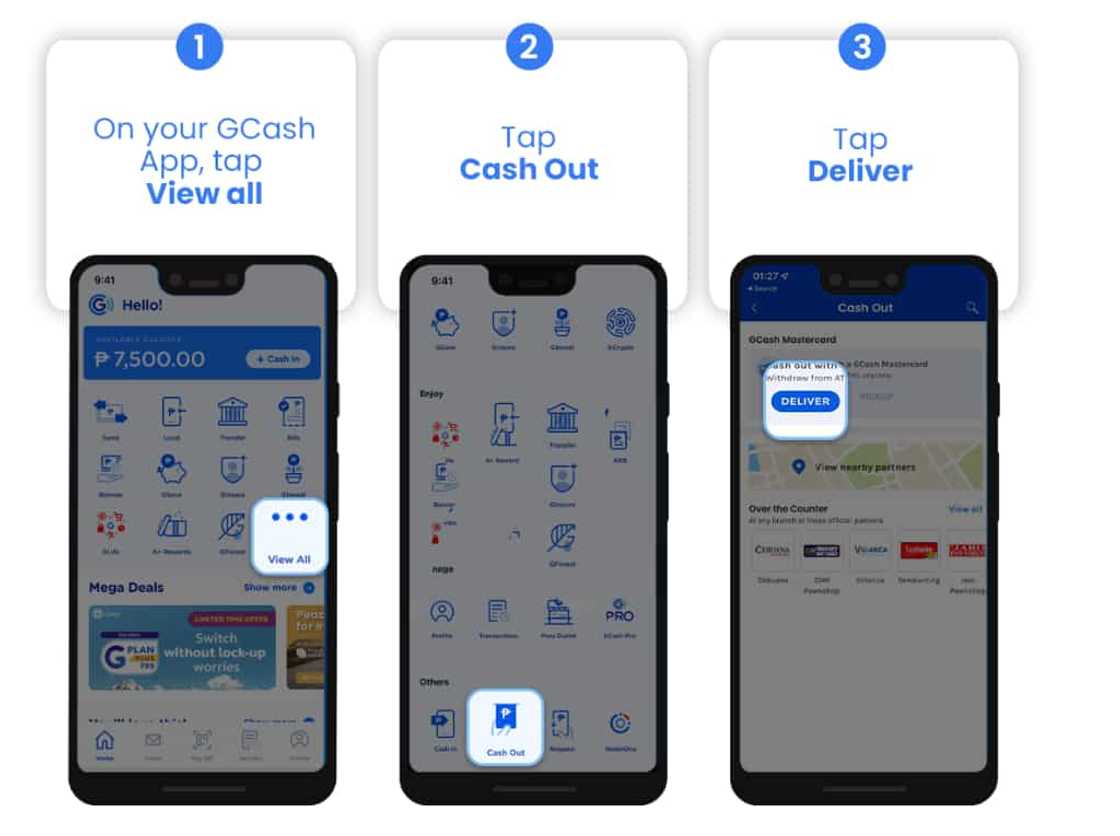

- Read the instructions on how to order the card online.

- Scroll down to the "GCash Mastercard Order Form" and fill it.

- Click the small box to accept the Terms and Conditions.

- Click "Next" and pay attention to the Order ID on the screen.

- Tap "Pay" and pay ₱215.

- A message will pop up on your screen to confirm your payment.

Source: UGC

How to order a GCash MasterCard online via the order link

Applying for GCash through the online MasterCard order link is temporarily unavailable. Beware of fake mastercard sellers online.

How do I apply for a GCash Card through partner convenience stores

The GCash card is available at branches of these convenience stores:

- 7-Eleven

- Lawson

- Ministop

- All Day Convenience Store

- All Day Supermarket

You only pay a ₱150 application fee to buy the card at a convenience store.

Source: Facebook

Can I use GCash Mastercard immediately?

Once you receive the card, link it to your GCash app and activate it. You cannot use your Mastercard without doing these two things.

How long does it take for GCash Mastercard to deliver?

Expect to receive your card within ten business days upon confirmation of your ₱215 payment (online applications) or ₱150 (applications at affiliate convenience stores).

How to track my GCash Mastercard

Read also

May karamay! Landbank to extend P50,000 student loan to help secure gadgets for online learning

You cannot do GCash Mastercard tracking online by yourself. Call GCash customer support via 2882 / (02) 782-2882 or send an email to support@GCash.com to check your GCash Mastercard delivery status.

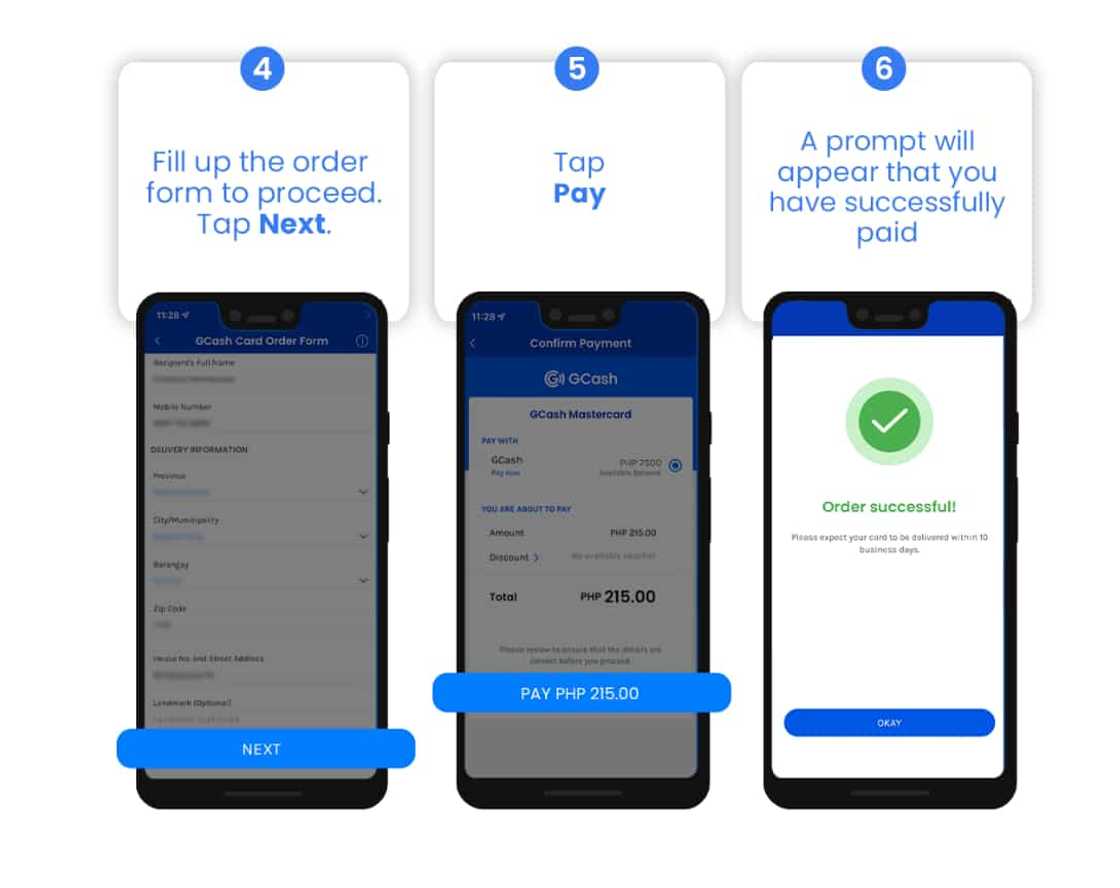

How to activate a GCash Mastercard

You activate your Mastercard by linking it to your GCash account. The card comes with an activating manual and how to use it once it is linked to your account. There are two ways of activating the card:

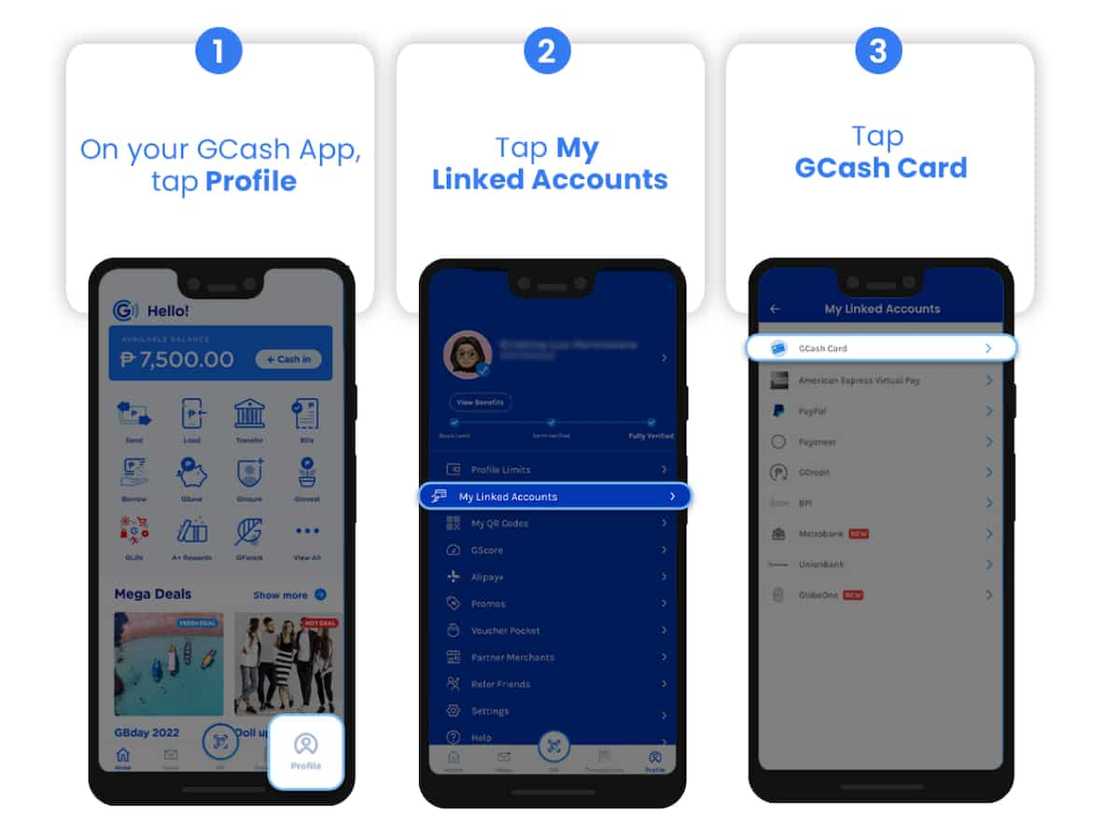

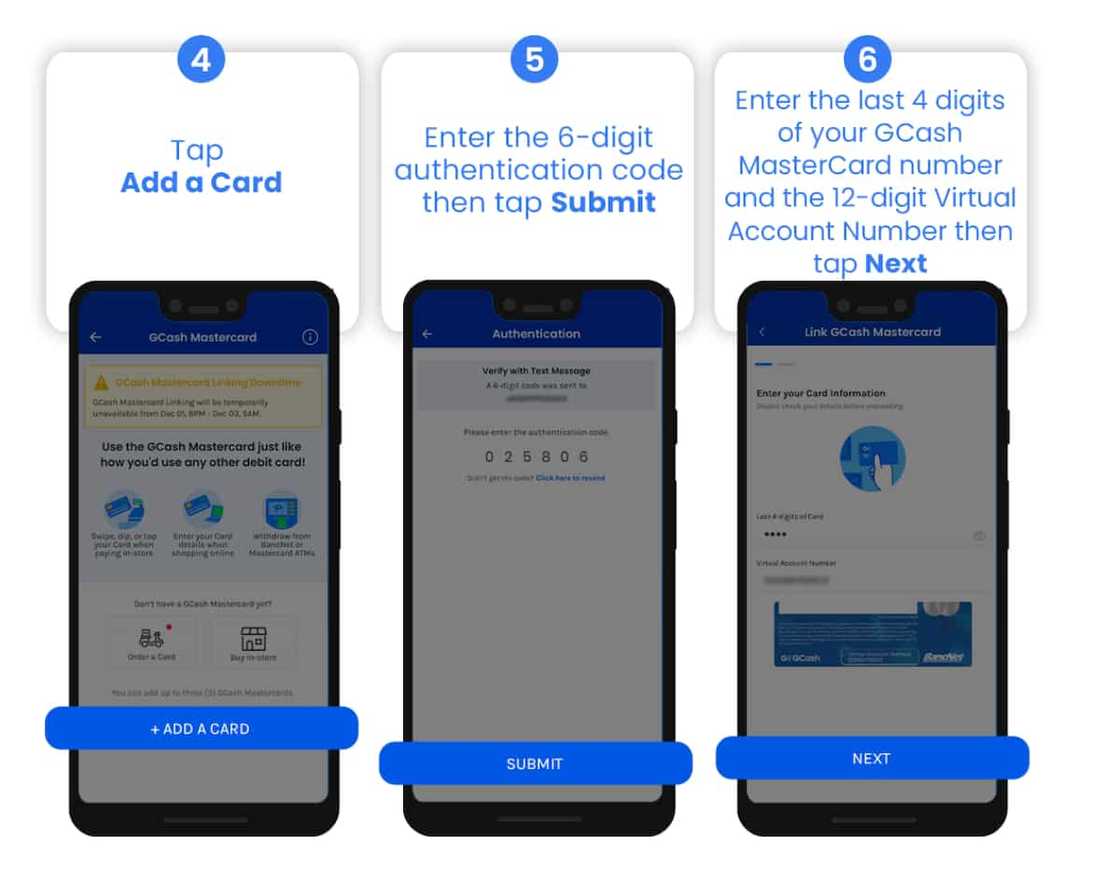

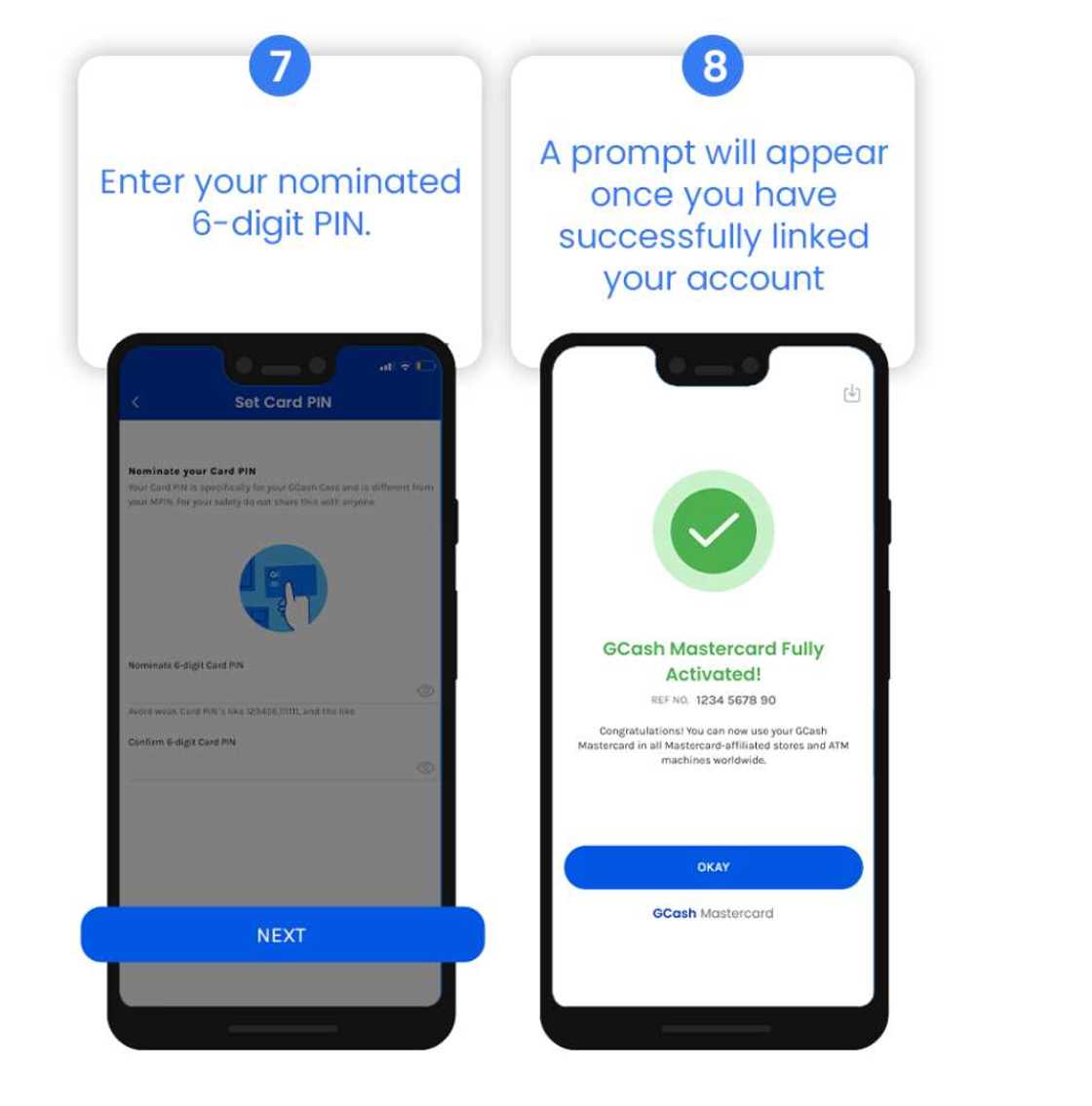

How to activate your GCash MasterCard via the GCash app

- Open your GCash app and enter your MPIN to log in.

- Tap the "Profile" icon on the GCash homepage.

- Select "My Linked Accounts."

- Choose "GCash card" from the list.

Source: UGC

- Tap "Add a Card" to add a card.

- Enter the 6-digit authentication code sent via SMS to your GCash-registered mobile number.

- Enter the 4 last digits of your GCash Mastercard number.

- Enter the 12-digit GCash Virtual Account number.

- Click "Next."

Source: UGC

- Enter your nominated 6-digit PIN.

- Click "Link Card."

- You will see a prompt if the card was successfully or not successfully activated.

Source: UGC

How to activate your GCash MasterCard via USSD code

- Dial *143#

- Select GCash > 2 GCash Card > 1 Activate Card.

- Fill in the necessary details from your Mastercard.

- You will receive a message if the card has or has not been successfully activated.

Ways of using the GCash MasterCard

The MasterCard has many features that enable you to pay bill payments, send & withdraw money, and make online/offline shopping payments locally and internationally in various currencies. You can also transfer money from Payoneer and PayPal to your GCash wallet.

Can GCash Mastercard be used internationally?

You can pay using this Mastercard at around 35.9 million card merchants in 210 countries and 150 currencies.

How can I register to Payoneer using GCash?

You can transfer money from Payoneer to your GCash account. Here is how to register to Payoneer using the GCash app:

- Open your GCash app and enter your MPIN to log in.

- Tap the "Profile" icon on the GCash homepage.

- Select "My Linked Accounts."

- Choose "Payoneer" from the list.

- Select "Create an Account."

- Tap on "Create an Account" to enter your details manually. Alternatively, tap "Register with GCash" to fill out your GCash information automatically.

- Fill out the necessary information to successfully create an account.

- A confirmation message will appear on the screen to inform you that your application is being processed.

- Tap "Okay" to exit.

Source: Facebook

Once you have submitted your Payoneer application, log into your Payoneer account to view your account status. You will receive an email from Payoneer that your application is being reviewed.

New applications are usually reviewed immediately, but some may take up to three (3) business days. You will receive an email from Payoneer to confirm whether your application has been successful or not.

How can I link my Payoneer to GCash?

Before you link your Payoneer account to GCash, ensure your Payoneer account is verified by Payoneer and your GCash account is verified. You may also be prompted to re-link your Payoneer to GCash if your Payoneer account has not received money for more than a month. Follow these steps to link your Payoneer account to GCash:

- Open your GCash app and enter your MPIN to log in.

- Tap the "Profile icon" on the GCash homepage.

- Select "My Linked Accounts."

- Choose "Payoneer" from the list.

- Tap "Link Account."

- Enter your "Payoneer login credentials."

- Enter the verification code received via SMS.

- Wait for confirmation via text message after the linking has been processed.

How can I cash into GCash with my Payoneer account?

Follow these steps to transfer money from Payoneer to GCash:

- Open your GCash app and enter your MPIN to log in.

- Tap "Cash In" on the GCash homepage.

- Select "Payoneer."

- Select the "currency balance" and input your "desired amount."

- Tap "Next."

- The amount will be converted into pesos (₱) on the cashier page.

- Review the amount, then select "Confirm."

- Enter the OTP code sent via SMS to your GCash-registered mobile number.

A blue confirmation page shows your Cash In is being processed. You will receive an SMS notification to confirm your Cash In was successful, and the balance will reflect on your GCash wallet balance.

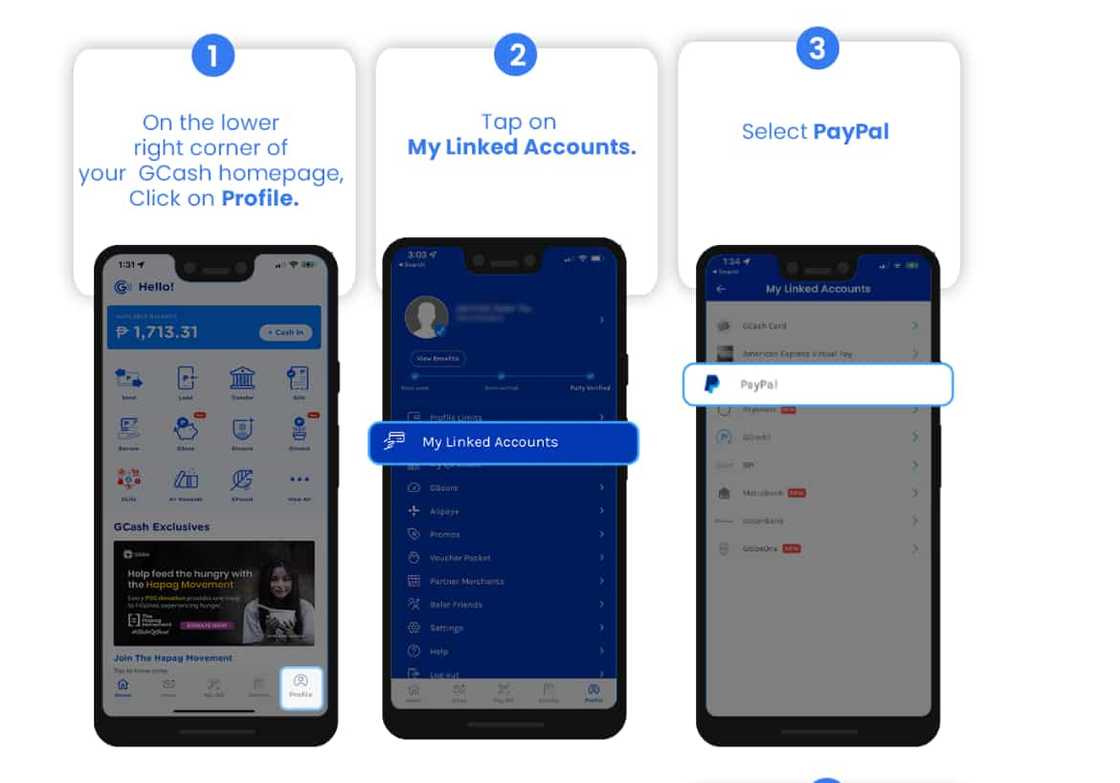

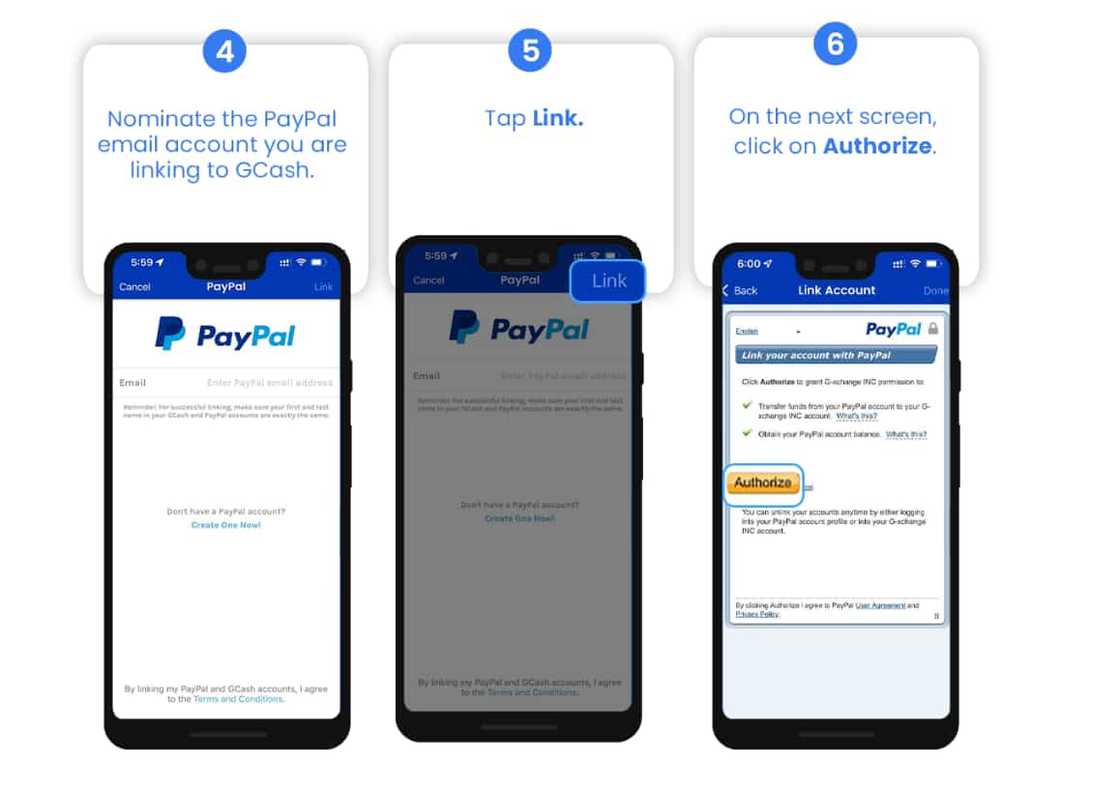

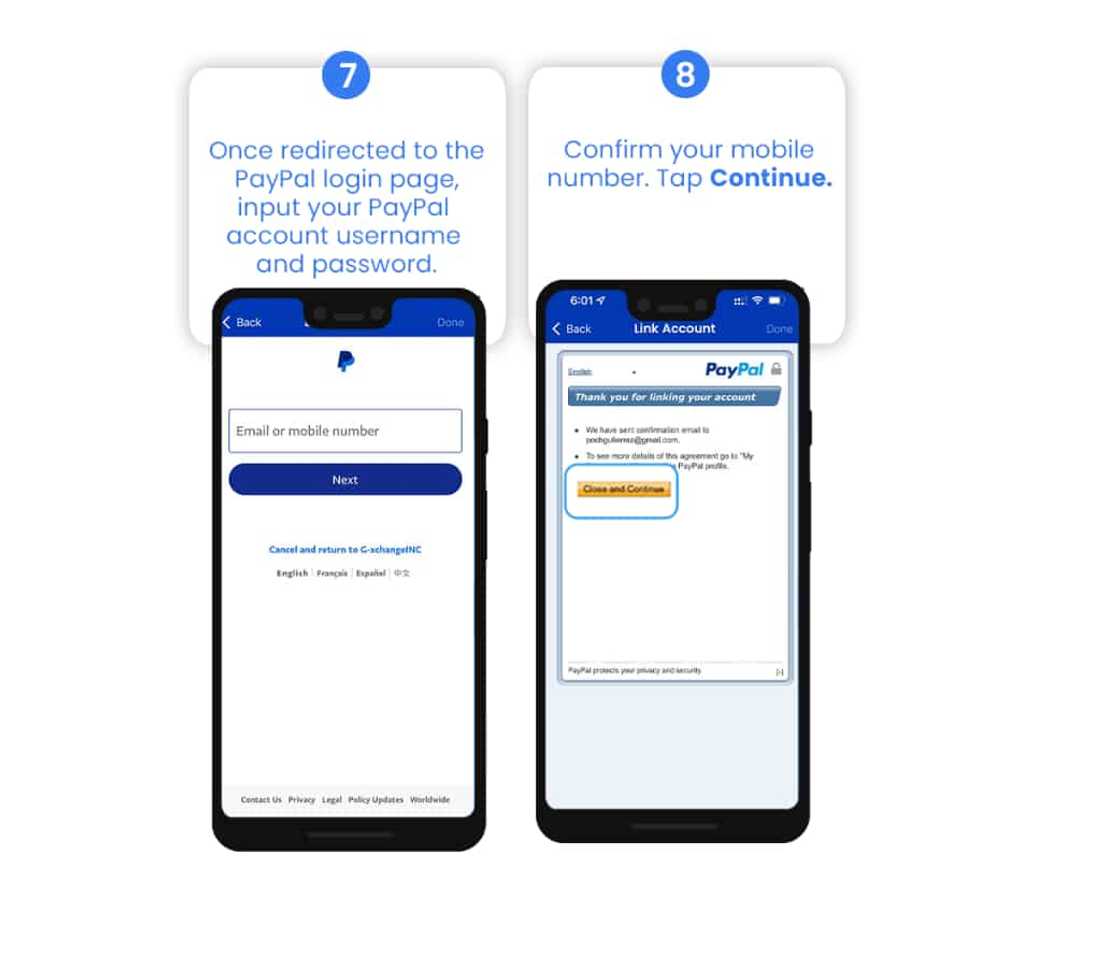

How do I link my PayPal to GCash?

Here is how to get started with GCash MasterCard and PayPal:

- Open your GCash app and enter your MPIN to log in.

- Tap on the "Profile" icon on the GCash homepage.

- Select "PayPal."

Source: UGC

- Choose the PayPal email account you want to link to your Gcash account.

- Tap "Link."

- Click "Authorize" on the next screen.

Source: UGC

- You will be redirected to the PayPal login page.

- Enter your PayPal username and password.

- Confirm your mobile number, then tap "Close and Continue."

Source: UGC

How do I cash in with PayPal?

Follow these steps to transfer money from PayPal to your GCash account:

- Open your GCash app and enter your MPIN to log in.

- Tap on "Cash In" on the GCash homepage.

- Select "PayPal" under the Global Partners and Remittance tab.

- Enter the amount you wish to add to your wallet (minimum ₱500).

- Tap "Next."

- Confirm the amount for cash in.

Most Globe GCash and PayPal transactions are processed within the next 24-48 hours. You will receive an email and SMS notification once the funds have been added to your GCash wallet.

For seamless transactions and withdrawals, convert your PayPal funds into Pesos (₱). You can also check and increase your wallet cash limits to hold more money.

Where can I withdraw money using GCash MasterCard?

You can withdraw money at affiliated Bancnet ATMs (nationwide) and Card ATMs (worldwide). Simply look for a Mastercard or BancNet logo on the ATM. You can also withdraw money at any of these GCash Partner Outlets:

- Cebuana Lhuillier

- CVM Pawnshop

- DA5

- ECPay

- ExpressPay

- HanepBuhay

- Jaro Pawnshop

- Panalo Express

- PeraHUB

- Posible

- Puregold

- Robinsons

- SM Store

- Tambunting Pawnshop

- TrueMoney

- Villarica Pawnshop

- VIP Payments Center

Source: UGC

Each Partner Outlet has its own withdrawing steps. You should also learn how to Cash Out using a non-Philippine-issued SIM if you have one.

What is the GCash MasterCard withdrawal fee?

The GCash MasterCard withdrawal fee is:

- 2% of the amount you withdraw over the counter at GCash Partner Outlets.

- ₱10 to ₱18 ATM withdrawal fee (as charged by banks servicing the ATMs).

- ₱150 ATM Withdrawal fee (International).

How much is the transaction fee for GCash?

Charges apply for withdrawing and sending money, paying bills, and online/offline Card Purchases. Below are all GCash transaction fees:

Product | Description | Charges |

Cash In | Bank account to the GCash app (BPI and Unionbank). | Free |

Mobile bank app to the GCash app (Fees depend on bank partners). | ₱0 to ₱50 | |

Remittance to the GCash app (Moneygram, WU). | Free | |

Over-the-counter outlets fee if you exceed ₱8,000 monthly free limit. | 2% | |

Cash Out | Over-the-counter withdrawal fee at GCash Partner Outlets. | 2% |

ATM withdrawal fee (as charged by banks servicing the ATMs). | ₱10 to ₱18 | |

ATM Withdrawal fee (International). | ₱150 | |

GCash card order fee | Offline Card Purchase. | ₱150 |

Online Card Purchase (₱150 order fee plus ₱65 delivery fee) | ₱215 | |

GCredit | Interest for the total credit purchased within the billing period | 3-5% |

Penalty for not paying total credit amount (1-30 days after the due date). | ₱200 | |

Penalty for not paying total credit amount (31-60 days after due date). | ₱500 | |

Penalty for not paying total credit amount (61-90 days after due date). | ₱900 | |

Penalty for not paying total credit amount (90 days after due date). | ₱1500 | |

GLoan | One-time processing fee in addition to the loan amount. | 3% |

Late GLoan payments incur ₱100 fixed fee and an additional 0.15% of the principal outstanding balance (charged daily) | ₱100 + 0.15% outstanding balance | |

Pay Bills | Billers with fixed fees (refer to the app for actual fees per biller) | ₱0 to ₱60 |

Billers with percentage-based fees (refer to the app for actual fees per biller) | 2% | |

Send Money | via Express Send | Free |

via Bank Transfer | ₱15 | |

via Ang Pao | Free | |

via Send with a Clip | Free | |

via GCash Padala | ₱5 or 1.5% | |

Request Money | via Request Money or KKB | Free |

General Account | Balance Inquiry via ATM | ₱3 |

Balance Inquiry via ATM (International) | ₱50 | |

Dormancy fee | ₱50 | |

GCash PRO Biz Starter 99. | ₱99 |

GCash MasterCard is available to all verified GCash account holders. This article helps you understand how to apply for it, the application and delivery fee, where to apply, transaction fees you pay when using the card, and more details.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Kami.com.ph explained how to apply for a BPI Blue Mastercard. The BPI card is the sole property of the Bank of the Philippine Islands (BPI), the first bank established in the Philippines and Southeast Asia.

The card is issued for the personal use of the cardholder and is non-transferable. The article lists the requirements to qualify for this card and how to check if your application has been accepted.

Source: KAMI.com.gh