How to open BPI savings account 2023: online registration and requirements

A BPI savings account enables you to save money for bigger goals like business investments and education. Depositing cash in BPI savings accounts through insurance earns interest and also comes with life insurance worth three times your account balance. Learn how to open BPI savings account below.

Source: UGC

The Bank of the Philippine Islands (BPI) is one of the oldest and fourth-largest banks in the Philippines. It has maintained an outstanding reputation since its establishment in 1851. BPI diligently served Filipinos in tough times like the 1997 Asian financial crisis.

How can you open a BPI savings account?

Keeping money in a BPI savings account is rewarding. Their competitive interest rates grow your money as you save. You can withdraw your savings or let it earn bonus interest for not cashing out within the month. Here are things to keep in mind when planning to open an account:

- Find out the requirements to open a BPI account.

- Identify the account that best suits your financial needs.

- Learn about the application or account opening process.

What are the BPI savings account requirements?

You should have savings accounts before opening a checking account. You can withdraw cash from a checking account anytime. A savings account allows you to accumulate money for a specific duration and remove it later.

Source: Facebook

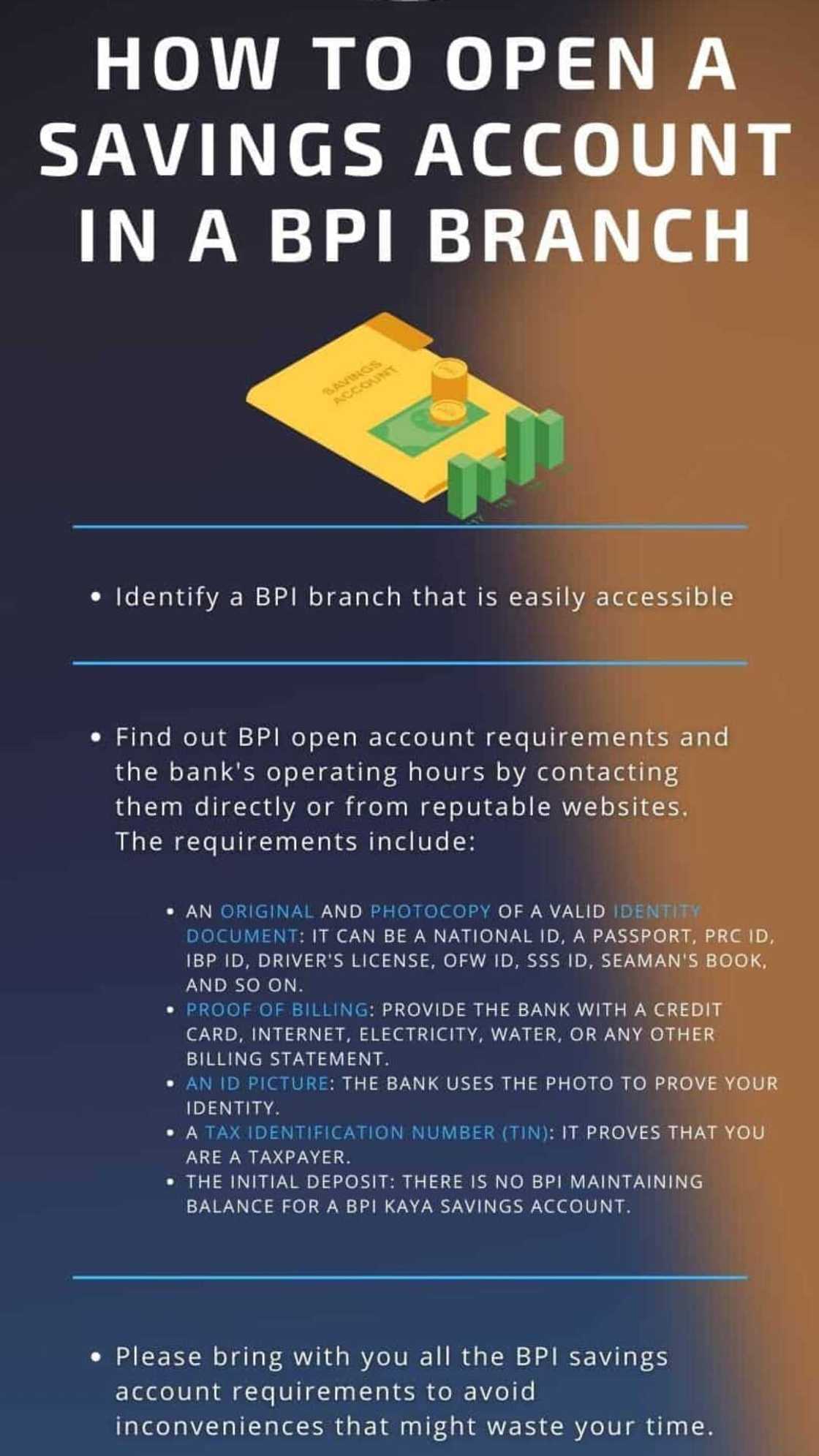

Below are the requirements to open a BPI account:

- Proof of billing (A credit card, internet, electricity, water, or any other billing statement.).

- Required initial deposit

- A tax identification number (TIN)

- One of the following photo-bearing and unexpired IDs:

A Filipino citizen need the following:

- PhilID

- Identification documents issued by the Philippines government, including political subdivisions, agencies, and instrumentalities (your passport, PRC ID, IBP ID, driver's license, OFW ID, SSS ID, Seaman's book, etc.).

- Other identification documents verifiable through reliable, independent source documents, data, or information.

For a Filipino student:

- PhilID

- Birth Certificate issued by the Philippine Statistics Authority

- School lD signed by the school principal or head of the educational institution

For a foreign national:

- PhilID for resident aliens

- Passport

- Alien Certificate of Registration issued by the Bureau of Immigration

- Any other identification document verifiable via reliable, independent source documents, data, or information.

Source: Facebook

Can you open a bank account online without going to the bank?

If you don't have an account with this bank, check the BPI savings account requirements. Bring the documents to the nearest branch to open a Regular Savings or US Dollar Savings account. You can open these accounts online or at a BPI branch if you already have an account with the bank.

BPI online application process for savings accounts

Here is how to open BPI savings account online if you do not have an account with this bank:

- Download and install a BPI Mobile app on your phone.

- Tap “Open a New Account” on the app's login screen.

- Click "Create a bank account."

- Fill out your personal details and choose the type of account you want.

- Take a clear picture of your ID (it should be valid and acceptable by BPI).

- Take a clear selfie.

- Fill in the additional details.

- Review your application for errors.

- Click "Confirm" to create your account.

- Put money in your account within seven days.

Source: Facebook

How to open a Regular Savings account online

Here is how to open a regular BPI savings account online if you have an account with this bank:

- Download and install a BPI Mobile app on your phone.

- Choose “Open a New Account” on the app's login screen.

- Click “Open another deposit account.”.

- Click “Open account now.”.

- Select “PHP” as currency.

- Pick “Regular Savings with Debit Card.”

- Read and agree to the terms and conditions.

- Click “Confirm.”

- You may now fund your Regular Savings account.

Source: Facebook

BPI online application for a US Dollar Savings account

Here is how to open a US Dollar Savings account online if you have an account with the BPI bank:

- Download and install a BPI Mobile app on your phone.

- Choose “Open a New Account” on the app's login screen.

- Click “Open another deposit account.”

- Click “Open account now.”

- Select “USD” as currency.

- Choose “Regular Savings with Debit Card.”

- Read and agree to the terms and conditions.

- Click “Confirm.”

- You may now fund your US Dollar Savings account.

Source: Facebook

How to open a Pamana Savings account

BPI Pamana Savings is a card-based savings account. It gives free life insurance worth three times your account balance. Premium payments and medical check-ups are not required. You can choose a Pamana passbook or US Dollar savings account. Bring the required documents to the nearest BPI branch to open a Pamana Savings account.

How to open a Maxi Saver account

BPI Maxi Saver is a card-based savings account. You get an additional 0.125% interest per annum if you don’t make any withdrawals within the month. Bring the required documents to the nearest BPI branch to open a Maxi Saver account. You can choose a Maxi Saver US Dollar or passbook savings account.

Other BPI savings accounts

Other BPI savings accounts are:

- SaveUp - An all-digital savings account that allows you to do everything online.

- MySaveUp - An all-digital BPI savings account you exclusively open using the GCash app.

- Saver Plus - A savings account with higher interest than a regular savings account.

- Pamana Padala - A savings account for overseas Filipino remitters.

- Padala Moneyger - A savings account for those who receive remittances from abroad.

- Jumpstart - A savings account for teens aged 10-17 years old.

Source: Facebook

For all these other BPI accounts, except the SaveUp and MySaveUp, bring the required documents to the nearest BPI branch to open the account you want.

How to open a SaveUp account online

You can do everything online on this account, from opening an account, transferring funds, paying bills, loading money on e-cards, and more. Here is how to open a BPI SaveUp account online, whether you have or don't have an account with this bank:

- Download and install a BPI Mobile app on your phone.

- Choose “Open a New Account” on the app's login screen.

- Click “Create a bank account.”

- Confirm your nationality.

- Read and confirm our privacy statement.

- Enter your mobile number and email address.

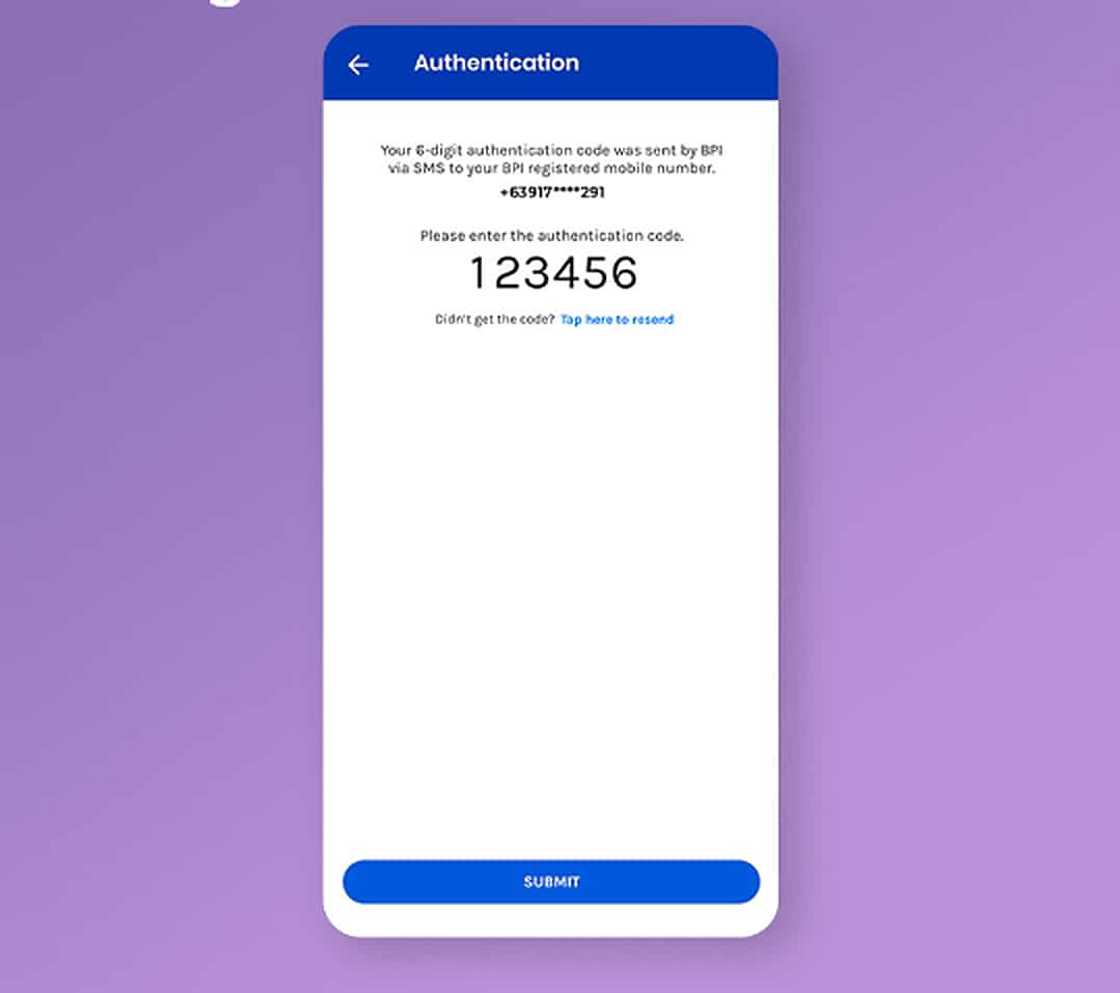

- Input the One-Time-PIN sent via SMS to your phone.

Source: Facebook

- Take note that the only available product is #SaveUp digital.

- Read and agree to the terms and conditions.

- Fill in the required information.

- Choose from BPI’s list of accepted IDs

- Scan your ID. Ensure the image is clear.

- Take a selfie to verify your identity.

- Fill in the additional details.

- Review your application and click “Confirm."

- Create your username and password.

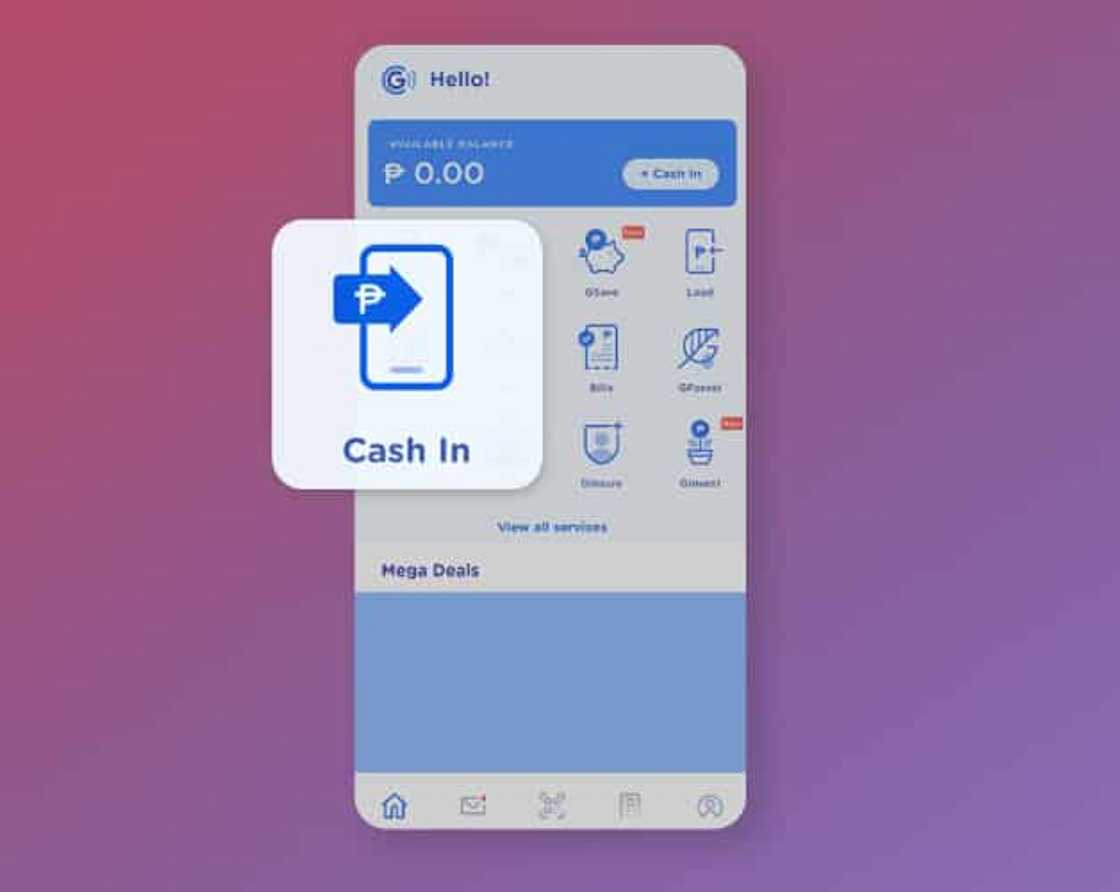

How to open a MySaveUp account

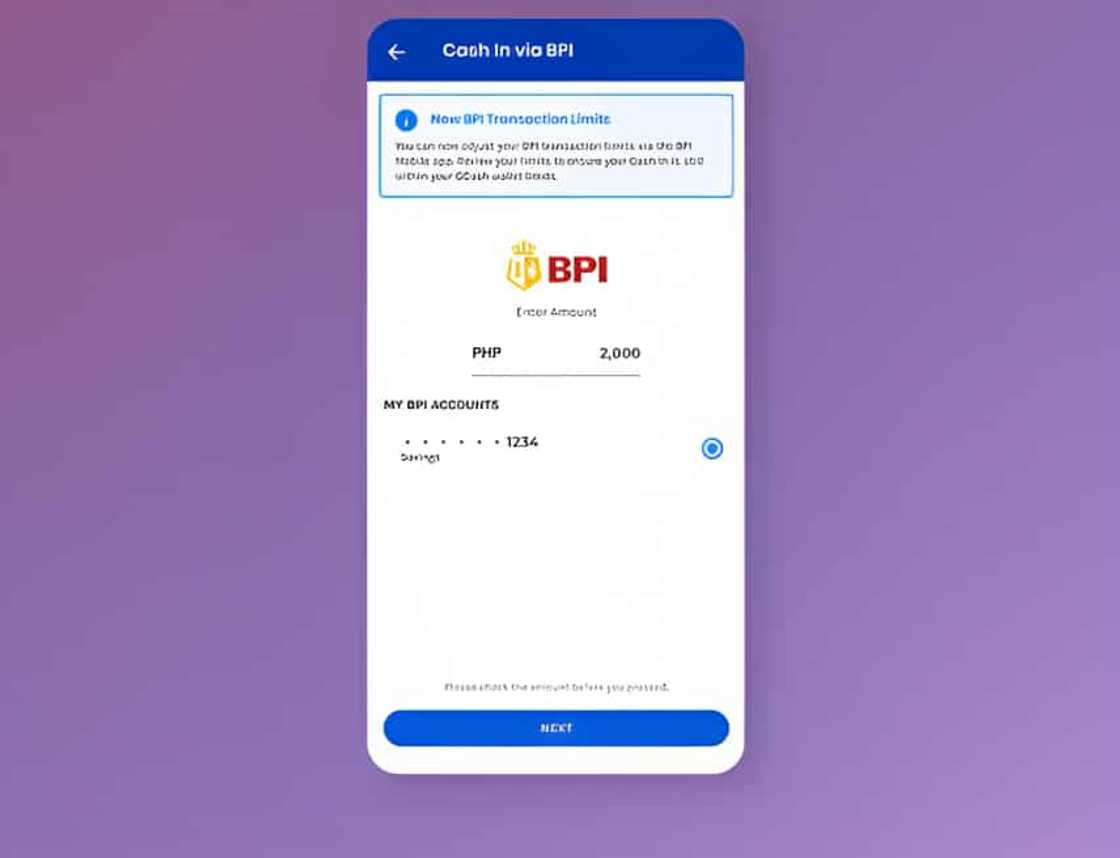

Sending money between the GCash wallet and BPI MySaveUp account via GSave is free. You can also manage your account through your GSave (GCash app) or the BPI Mobile app. Here is how to open a BPI MySaveUp account whether you have or don't have an account with this bank:

- Log in to your GCash account.

- Click "GSave" in your dashboard.

- Choose #MySaveUp by BPI from the GSave Marketplace.

- Click "Open a Savings Account."

- Click “Proceed using my GCash Profile” or “Proceed using BPI Online Account” (whichever applies to you).

- Enter the requested personal details.

- You will see a confirmation screen once successful.

Will there be maintaining balance on the accounts opened online?

Here are the monthly maintaining balance on BPI accounts opened online:

BPI account | Monthly maintaining balance |

Regular Savings account | ₱3,000 |

US Dollar Savings | $500 |

Pamana Savings | ₱25,000 |

Maxi Saver | ₱2 million |

Jumpstart | ₱1,000 |

Padala Moneyger | ₱0 |

Pamana Padala | ₱0 |

Saver Plus | ₱50,000 |

MySaveUp | ₱3,000 |

SaveUp | ₱3,000 |

How much is the minimum amount to open an account in BPI?

Below are the required initial deposit and other financial obligations you incur for each BPI savings account and how much annual interest you money earns in each account:

BPI account type | Required Initial Deposit | Minimum Monthly ADB | Daily Balance to Earn Interest | Annual Interest Rate |

US Dollar Savings | $500 | $500 | $500 | 0.050% |

Regular Savings | ₱3,000 | ₱3,000 | ₱5,000 | 0.0625% |

Pamana Savings | ₱25,000 | ₱25,000 | ₱25,000 | 0.0625% |

Maxi Saver | ₱2 million | ₱2 million | ₱2 million | 0.125% |

Jumpstart | ₱100 | ₱1,000 | ₱2,000 | 0.0625% |

Padala Moneyger | ₱0 | ₱0 | ₱5,000 | 0.0625% |

Pamana Padala | ₱500 | ₱0 | ₱5,000 | 0.0625% |

Saver Plus | ₱50,000 | ₱50,000 | ₱50,000 | 0.0925% |

MySaveUp | ₱1 | ₱3,000 | ₱5,000 | 0.0925% |

SaveUp | ₱1 | ₱3,000 | ₱5,000 | 0.0925% |

How to open a savings account at a BPI branch

BPI encourages its customers to use the bank's online platforms. Nevertheless, its asset management teams and financial experts will guide you when you visit its branches to open an account. Below is the process:

- Identify a BPI branch that is easily accessible.

- Visit the branch during BPI banking hours. BPI open branches from 9:00 am to 4:30 pm.

- Approach the New Accounts Section and inquire about the BPI open account requirements.

- Please bring with you all the BPI savings account requirements to avoid inconveniences.

- Present all the requirements to the New Accounts Section.

- The staff will give you an application form to fill.

- Hand the filled application form to the staff serving you.

- The staff will give you the procedure for paying the initial deposit.

- After paying for the initial deposit, the bank will confirm (within 24 to 48 hours) via email that the process is successful.

- Contact the bank if you do not receive an email informing you that the account is active.

Source: Twitter

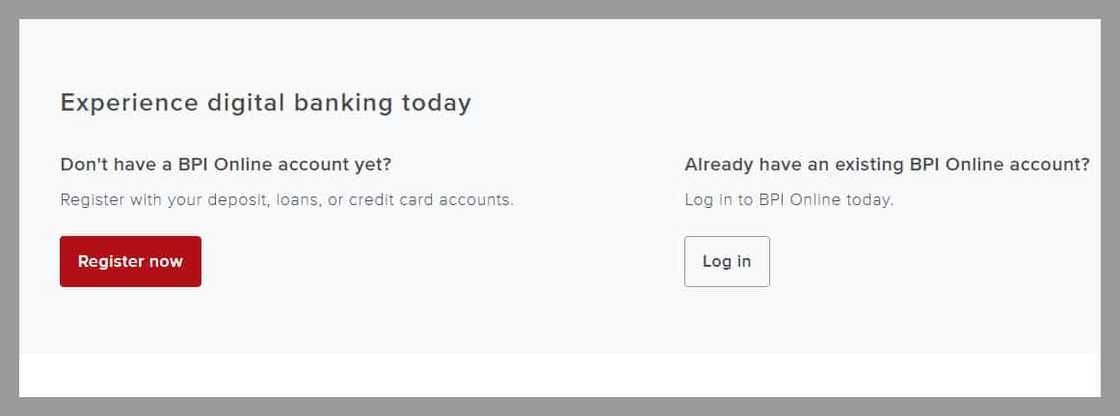

How can I use BPI Express online?

BPI Express Online is an internet-based cash management system. You need a deposit, credit card, or loan account to enroll for the service. BPI online banking makes your everyday banking easier. You pay your government fees, billers, merchants, etc., through this platform. Here is how to enroll your deposit, credit card, or loan account on BPI online banking:

- Visit the BPI website.

- Click "Ways to Bank."

- Scroll down to "Don't have a BPI Online account yet?" and click “Register Now.”

Source: Facebook

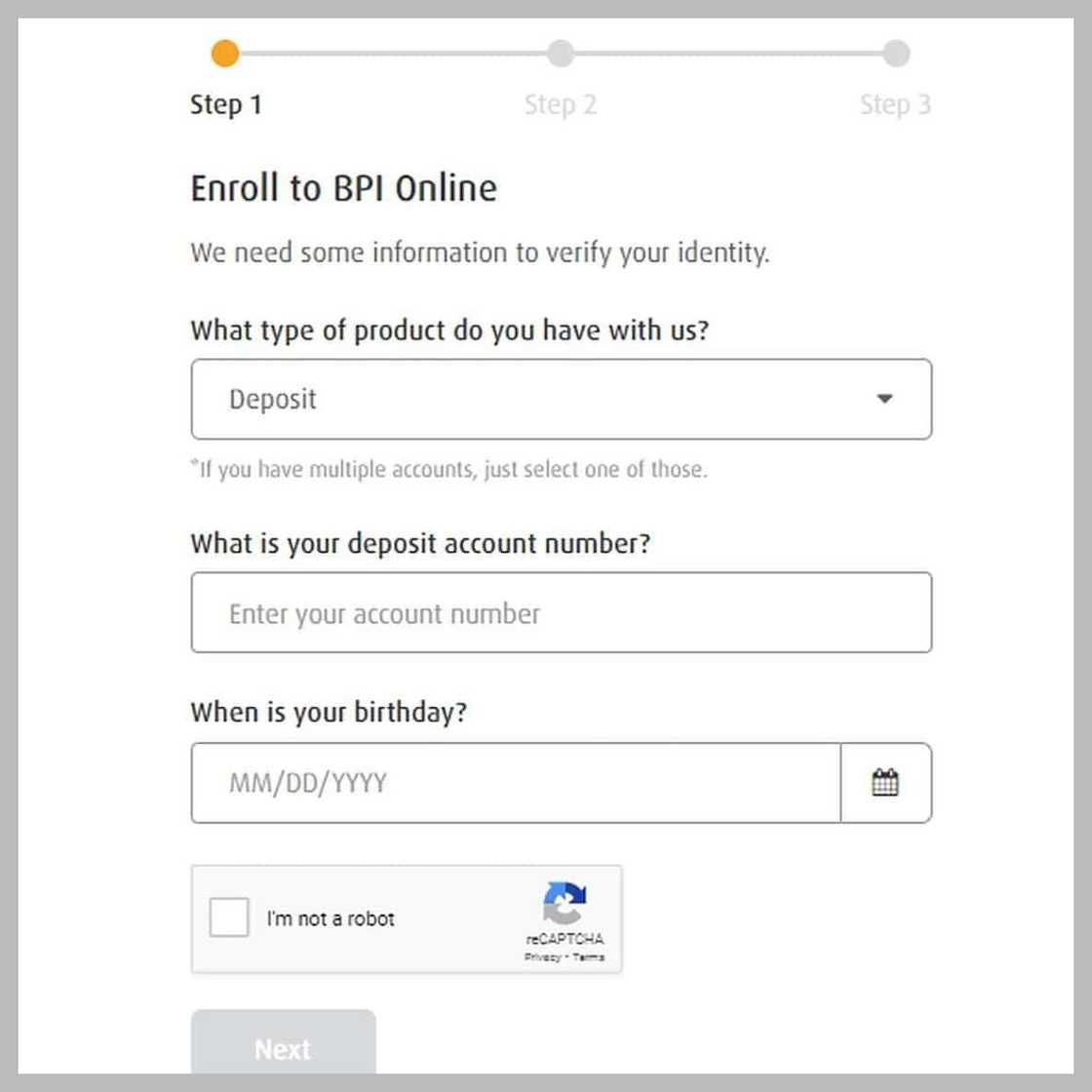

- Choose your preferred product type (deposit, credit card, loan).

- Enter your account number, customer number, or loan account number.

Source: UGC

- Select your date of birth.

- Create your username and password.

- Enter your email address.

- Read the Terms and Conditions.

- Click “Submit.”

- Enter your One-Time-PIN.

- Click “Submit.”

You can download and install a BPI Mobile app on your phone and log into your online account via the app or the BPI online webpage. Alternatively, apply for a BPI ATM at your nominated branch. Change your ATM card's PIN to activate your account, and never disclose your BPI online login details or ATM card's PIN to anyone.

Source: Facebook

How do I change the BPI ATM card's PIN?

Collect your passbook or ATM card from the bank and change your ATM card's PIN when you get the card. Here is how to change a BPI ATM card's PIN:

- Visit the nearest BPI ATM.

- Insert your card into the machine.

- Select your preferred language.

- Press the "NEXT" to change the PIN.

- Enter your new PIN and re-enter it.

- Enter the old temporary PIN.

- The ATM will display the message "Successful PIN change."

How do I get a BPI passbook?

If you prefer a passbook to an ATM card, ensure you provide the bank with a registered email for an easy flow of communication. Do the following things to activate the account:

- You will receive a confirmation email with a form attached to it.

- Print the form, then fill and sign it.

- Mail the completed form to this address: BPI Fulfillment Banking Department, 9th Floor BPI Card Center, 8753 Paseo de Roxas Makati City 1200, Philippines.

- The bank acknowledges receiving the form via email and when the passbook processing is complete.

How to apply for a BPI credit card

Choose a credit card that suits your earnings and expenditure lifestyle to avoid falling into heavy credit card debts. BPI has the following credit cards:

- BPI Visa Signature

- BPI Platinum Mastercard

- BPI Amore Platinum Cashback

- BPI Gold Mastercard

- BPI Blue Mastercard

- BPI Amore Cashback

- BPI Petron Mastercard

Source: Instagram

You are eligible for a credit card if:

- You have an active BPI account bank.

- You must be 21 years old or above.

- You are a Philippine resident or citizen.

- You must have a business or residence contact number

- You earn at least PHP 180,000 per annum.

- Each credit card has different minimum earnings requirements.

If you meet the required conditions, apply for a BPI credit card using these steps:

- Visit the BPI website.

- Click on "Cards."

- Click on "Credit cards."

- Tap "Apply now."

- Select "Yes" if you are an existing customer or "No" if you are new.

- Fill out the application form.

- Follow the prompts until you complete the application process.3.

How many days does a BPI credit card application take?

The BPI credit card approval process takes one to two weeks. Use the bank’s official website to track your application status online or contact the bank. You should not apply for another BPI credit card while waiting for an update. This may affect your pending application.

Source: Instagram

What BPI deposit accounts can you open online?

The BPI mobile app lets you open Regular Savings, US Dollar Savings, SaveUp, MySaveUP accounts, and others.

Can I open a Joint account online?

You cannot open a BPI Joint account online. Everyone who wants to join this account should have the required documents. You should visit the nearest branch with the documents to open the account. Below are the BPI Joint account requirements:

- Valid IDs (original and photocopy)

- TIN (Tax Identification Number)

- Phone number.

- Proof of address, such as utility bills.

- The bank's initial deposit amount.

- Passport photos.

Who can I contact for inquiries about opening a BPI account online?

Call the 24-hour BPI Contact Center at (+632) 7791-0077.

Opening a BPI savings account can be a wise financial move, and it is worth considering the addition of a checking account to effectively monitor your day-to-day and monthly expenses. With a checking account, you can maintain a budget and ensure that you have sufficient funds to allocate towards your savings account.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility

Kami.com.ph also shared details on how to open a BDO savings account. Discover the hassle-free way to open a BDO savings account. In this article, you will uncover the secrets to effortlessly setting up your account from the comfort of your own home. No more long queues or tedious paperwork.

The article unveils the simple steps to complete the online registration process, ensuring a seamless experience. The article also lists the required documents that will make you an account holder in no time.

Source: KAMI.com.gh