BPI credit card application 2023: process, requirements, status

The Bank of the Philippines Island is among the largest financial institutions in the country. The bank continues to enhance its services to facilitate the needs of its clients. For instance, the BPI credit card application process has now been digitized. What do you need to know before applying for one?

Source: UGC

Technology has significantly impacted how people transact different businesses. Currently, the Bank of the Philippines Island is allowing its customers to pay for goods and services even when they do not have funds in their accounts. However, the benefits are available to subscribers only.

BPI credit card application details

Here are all the critical details that will guide you on how to apply for a credit card in BPI.

BPI credit card requirements

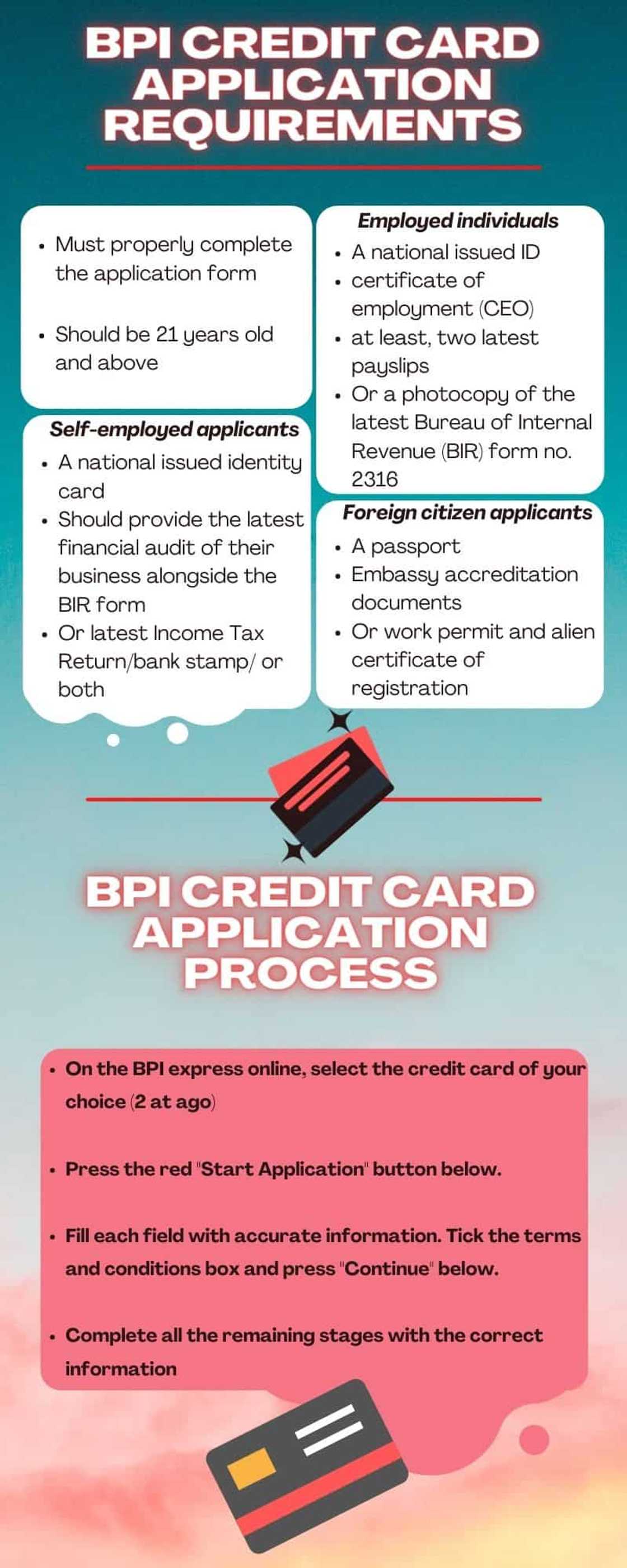

Overall, an applicant is supposed to fulfil the following requirements:

- Should be 21 years old and above

- Must properly complete the application form

Further, other specific requirements for various classes of applicants are as follows:

Employed individuals

- A national-issued ID

- certificate of employment (CEO)

- At least two latest payslips

- Or a photocopy of the latest Bureau of Internal Revenue (BIR) form no. 2316

Self-employed applicants

Source: UGC

- A nationally issued identity card

- Should provide the latest financial audit of their business alongside the BIR form

- Or the latest Income Tax Return/bank stamp/ or both

Foreign citizen applicants

- A passport

- Embassy accreditation documents

- Or work permit and an alien certificate of registration

Factors used to measure the eligibility of applicants

If you are wondering how to get a credit card in BPI, it is essential to remember this factor when applying for a credit card. Otherwise, one is likely to apply for the wrong debit card, which they cannot maintain or meet their needs. Consider the following aspects:

1. Age

It is compulsory to meet the recommended age; 21 years old and above for the principal holder category and 13 years old for supplementary cardholders.

2. Income

Income is based on the type of credit card one wants to apply for. For instance, a Blue MasterCard holder should be able to earn more than PHP 15,000 a year. On the other hand, Gold MasterCard cardholders must earn a minimum of PHP 1 million per year.

Importantly, it is a necessity to apply for one that can accommodate your lifestyle, such as spending habits. Besides, the wrong one may not be approved by the bank.

3. Contact details and home address

A residence or business number is compulsory. Also, your house must be within a radius of 30km from the headquarters of the bank or one of its family or provincial branches.

4. Nationality

The bank can only approve your application if you are a resident of the Philippines. In other words, you must have all the identification documents to prove that you are a Filipino national. The requirement also covers Overseas Filipino workers (OFWs).

BPI credit card application process

Source: UGC

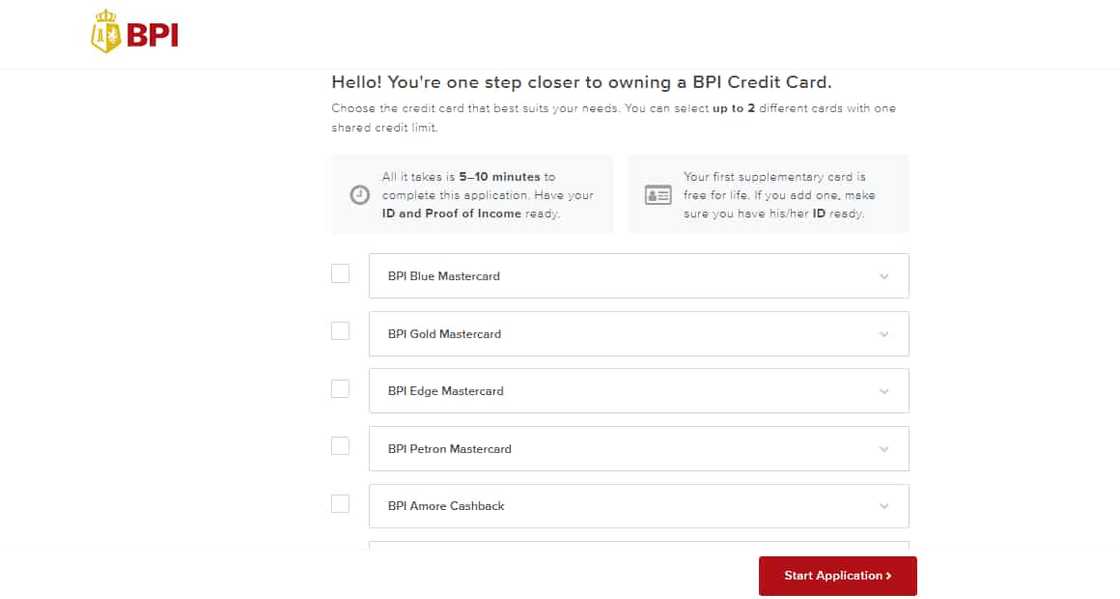

The simplest way to get your BPI-secured credit card approved fast is to create a BPI savings account. In the account, deposit a minimum of PHP 10,000.00. You can either complete the process at the nearest Bank of the Philippines Island or on BPI Express online. Overall, below is the breakdown of the process for completing a BPI credit card application form.

- Open the BPI official website.

- Click on "cards" and select "Apply for a Credit Card".

- You will be directed to a page where you must select whether you are an existing customer or not.

- Tick "No" and then click "Apply Now".

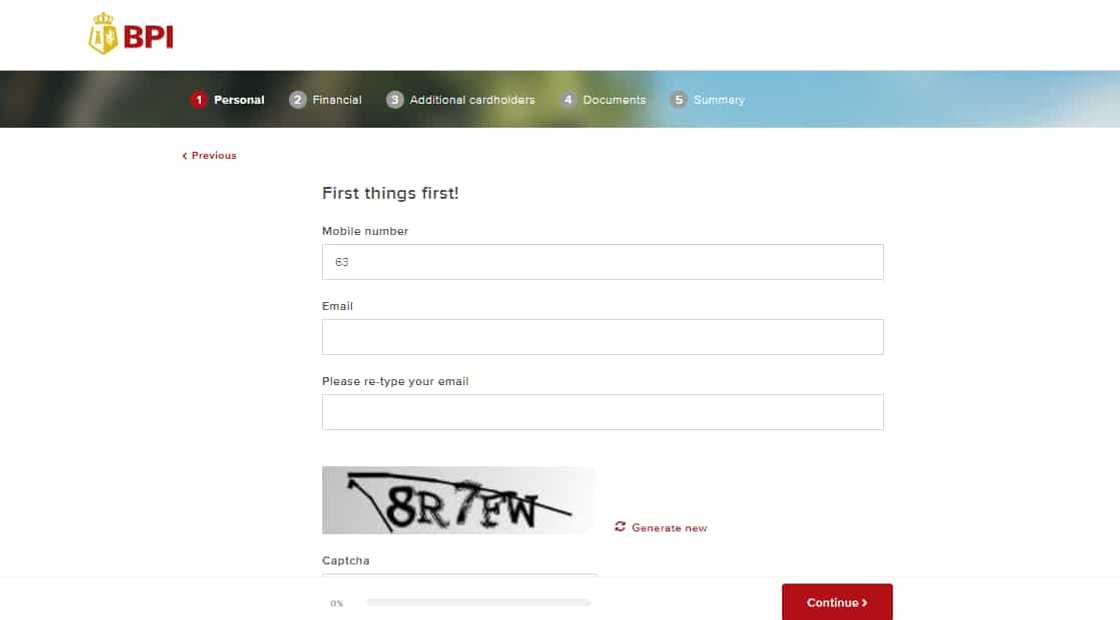

- You will be directed to another page. Select the credit card of your choice. Remember, you can choose two at ago.

- Proceed with the application process and fill each field with accurate information. After that, tick the terms and conditions box and press "Continue" below to go to the next stage.

- You are required to complete all the remaining stages with the correct information before completing the process.

NOTE: The process is divided into five phases; personal, financial, additional cardholders, documents, and summary. Also, the BPI credit card application processing time is usually estimated to range between 5 to 10 minutes.

How to check your BPI credit card application status?

Currently, the bank allows customers two options for tracking their BPI credit card status once the two weeks are over. The first option involves you calling them through their official numbers available on its website. Follow the prompts, and you will talk to an agent who will direct you on how to receive the document.

The second option, perhaps the most convenient one, is through the BPI website. Importantly, you need to sign in to your online account and click on "Other Services," after which you will find an option requiring you to inquire about your credit card status.

You can also track your credit card through a BPI credit card hotline number. Here is how to go about it:

- Call customer service at (+632) 889-10000 (metro manila) or its toll-free number 1-800-188-89100.

- Once the call has connected, press 2 (for Credit Cards) to continue

- Key in 2 again for the “Credit Card Application Status Inquiry” option

- Lastly, enter your 10-digit application ID

- You will be informed of your status or connected to an agent who will advise you further

How to check if your credit card application is approved?

Source: UGC

You can monitor the progress of your credit card application online via BPI's official website. You can also contact BPI customer service or visit the bank.

How to know if your BPI credit card application is declined?

Once you contact customer service, you will be notified if your card was declined or not. Instances when an application can be rejected, include:

- Several inconsistencies of information on your application form.

- Poor credit scores.

- Too low income.

- Invalid supporting documents such as the ID and ITR.

How long is the credit card application process?

Similar to other Filipino financial institutions, the Bank of the Philippines Island allows applicants a maximum of one to two weeks. However, this period can change based on various factors. At times, customers can be forced to wait for more than a month. Majorly, the earlier the bank approves your request, the earlier you are likely to receive your document.

What happens if you don't pay your minimum credit card?

If you don't pay the minimum amount due, interest charges may be applied to the remaining balance on your credit card.

The BPI credit card application process is easy. Ensure you submit the necessary documents to complete the application process. You can visit their offices or contact them if you have any further details.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Kami.com.ph recently published an article about the SOGIE bill in 2023. This legislation aims to protect Filipinos in the LGBTQIA+ community against discrimination. It seeks to penalize discrimination based on gender identity and expressions.

The SOGIE bill is significant because it encourages inclusivity, respect, and equality for all individuals. Understanding SOGIE can help to question established norms and prejudices, dispel stereotypes, and build a more inclusive and welcoming society.

Source: KAMI.com.gh