How to get TIN number for unemployed: requirements and details

Tax Identification Number, commonly referred to as TIN, is a unique set of combined figures given to every taxpayer. The Bureau of Internal Revenue issues the TIN, and it is used for tax-related transactions and identification. Whether employed or not, citizens of the Philippines are entitled to the TIN, according to Executive Order No. 98. Here is all you need to know about TIN ID requirements for unemployed individuals.

Source: Facebook

Securing the Tax Identification Number is one of the requirements upon employment or starting a business. Contrary to existing perception, it is not only for those employed alone as the unemployed and students can as well apply for the TIN.

TIN ID requirements for unemployed

The TIN ID is a system-generated set of combined characters assigned by the Bureau of Internal Revenue to people registered in its database. It is a permanent number, and everyone is supposed to have only one TIN in their lifetime.

The TIN allows you to transact with government and private offices. For example, with the TIN number, you will be able to acquire the following services:

- Apply for a driver’s license at Land Transport Office.

- Apply for NBI clearance.

- Apply for a passport at the Department of Foreign Affairs.

- Open a bank account.

- Apply for scholarships.

Can you get TIN ID even if you are unemployed? Yes. In this era of cutting-edge technology, getting TIN number for the unemployed has been simple. If you are unemployed, you will get it under Executive Order 98. It allows you to transact with the government in offices such as NBI, LTO, and DFA.

Source: UGC

According to the order, all government agencies, instrumentalities, Local Government Units, and Government-Owned Controlled Corporations (GOCCs) were to make it a requirement for the TIN in the application for government documents, permits, and clearance.

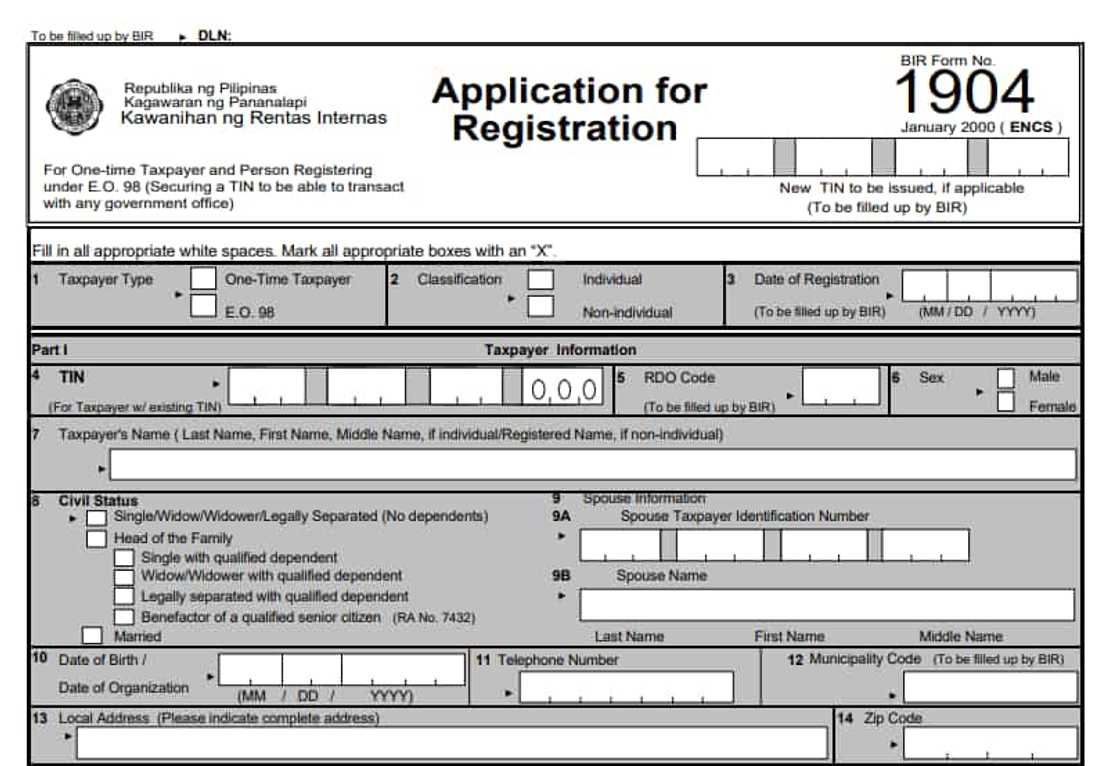

With this order in place, the Bureau of Internal Revenue began issuing TIN to individuals required to provide it in their transactions with the government. BIR Form 1904 was introduced, allowing you to get the TIN even if you are unemployed.

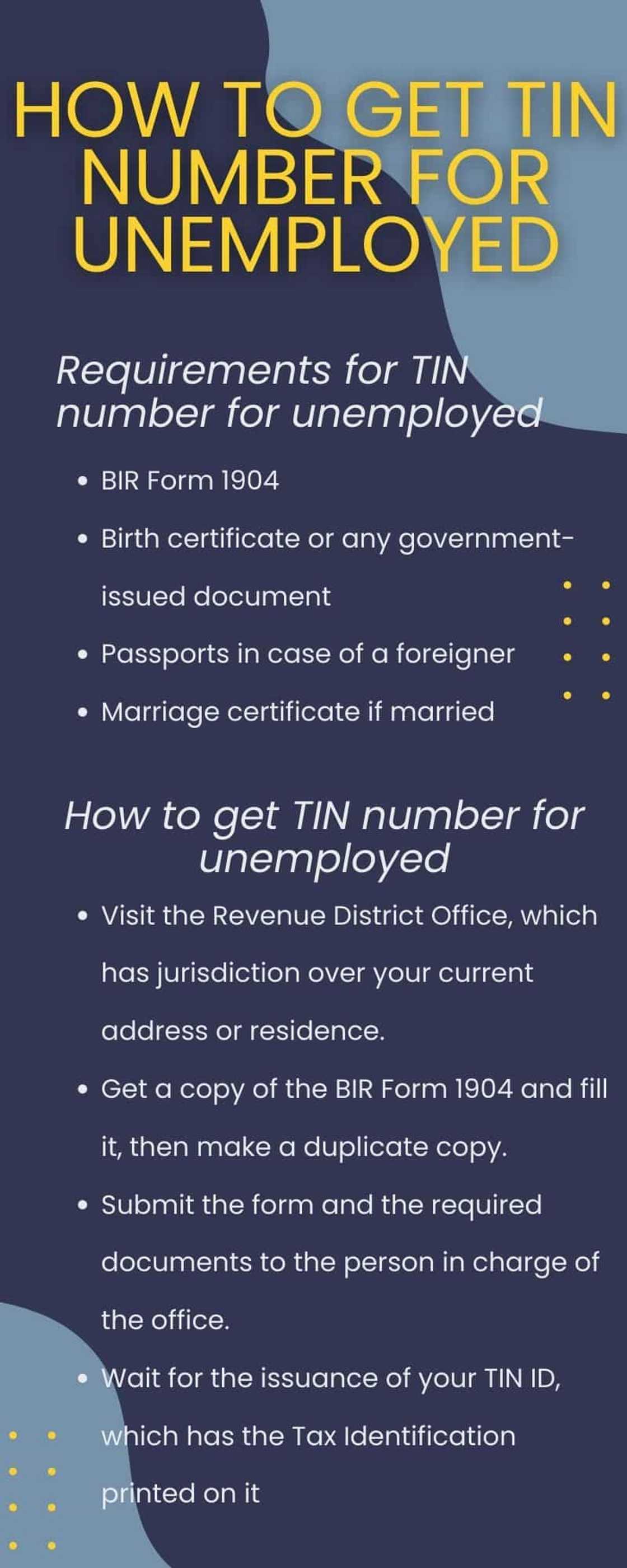

Requirements for TIN number for unemployed

To apply for the Tax Identification Number, the person has to own a particular set of requirements. They include:

- BIR Form 1904

- Birth certificate or any government-issued document

- Passports in case of a foreigner

- Marriage certificate if married

How to get TIN number for unemployed

The application procedure for how to get TIN ID is as follows.

- Visit the Revenue District Office, which has jurisdiction over your current address or residence.

- Get a copy of the BIR Form 1904 and fill it, then make a duplicate copy.

- Submit the form and the required documents to the person in charge of the office.

- Wait for the issuance of your TIN ID, which has the Tax Identification printed on it

Note: The TIN issued is a paper-based document and without any charge. No photo comes with the paper. You will have to attach your own 1 x 1 passport and laminate it to protect it.

An individual has to possess only one TIN during his lifetime. Having more than one is unlawful and liable to punishment, according to the National Internal Revenue Code of 1997.

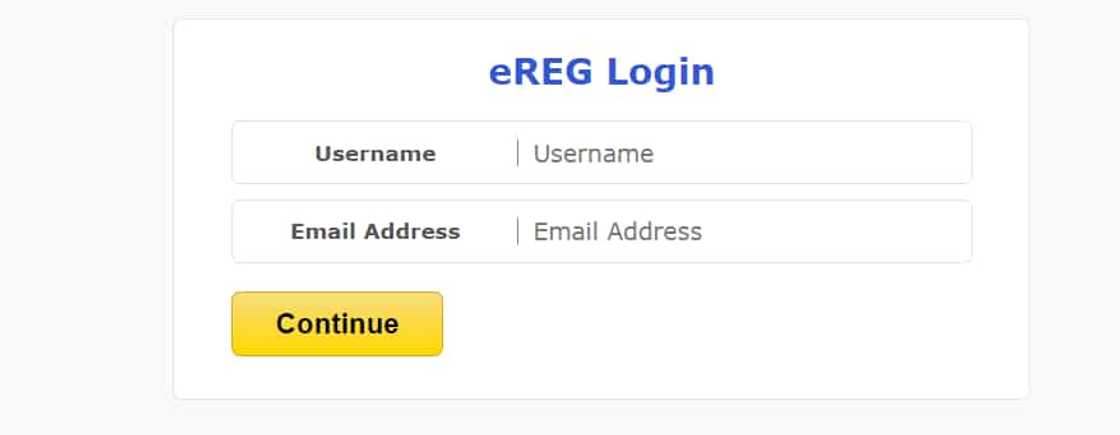

How to get TIN number for unemployed online

Did you know that you can get a TIN online? The internet has made it simple and convenient for citizens in the Philippines to apply for and acquire government documents online. One such material is the Tax Identification Number.

Source: UGC

With BIR eReg, Filipinos can get tax registration services without physically availing themselves at any BIR branch offices. Among the most crucial features of this web application system include;

- Issuance of TIN online

- Payment of registration fees

- Generation of the Certificate of Registration

At the moment, the system is temporarily unavailable. It shall be communicated once the system is back. Therefore, at the moment, if you wish to get TIN, kindly visit your nearest BIR branch office.

Source: UGC

How to verify TIN number

The BIR launched the Mobile Taxpayer Identification Number (TIN) Verifier app to provide taxpayers with a convenient way to recover or verify their TINs. You can receive real-time responses to their TIN-related inquiries at the touch of their fingertips. The BIR TIN verification serves two purposes. They include TIN inquiry and TIN validation.

A TIN ID is required for every Filipino citizen who wants to engage in business, pay taxes, or receive government services. The above TIN ID requirements for unemployed will help you understand what you need to have before applying for one.

Kami.com.ph also published an article on NBI clearance renewal. The demand for the NBI clearance document is high in almost all public sectors. Therefore, there is a need for you to possess an updated document.

Although the process is quite simple, many people still find it difficult to renew this document. Fortunately, there are various options for doing it; depending on where you are and other factors, you could opt for any.

Source: KAMI.com.gh