How to get TIN ID in 2023: online registration, application and verification

A Tax Identification Number is an essential document that every Filipino taxpayer should strive to possess. The document serves as proof of membership in the Bureau of Internal Revenue (BIR) and as a valid ID. Now that it is a crucial requirement for government-related transactions, everyone must learn how to get TIN ID.

Source: UGC

Every day the Bureau of Internal Revenue receives numerous applications for these identification documents. However, before heading to any BIR branch across the country, an applicant would want to know a summary of the process involved. There are a few things you must keep in mind when applying for this document. Nonetheless, the steps are simple and easy.

Tax Identification Number (TIN ID)

A Taxpayer Identification Number is an identification number used by the Internal Revenue Service (IRS) to administer tax laws. Therefore, the Internal Revenue Service issues the document.

Is TIN the same as SSN? A Tax Identification Number for an individual is formatted in the same way as a Social Security number: 123-456-789. However, the two documents are not the same. A Social Security number (SSN) is issued by the Social Security Administration, whereas the IRS issues all other Taxpayers Identification Numbers.

What does the card look like? From the available TIN ID sample, it is yellowish paper or thin cardboard with the BIR logo. The card does not expire, meaning it is valid forever, and you do not need to renew it.

How to get a TIN number in the Philippines

A TIN ID, sometimes called a TIN card, is an identification card with the holder's BIR TIN number, full name, address, passport-size photo, signature, date of birth, and date of issue.

The BIR issues the card for free, and it does not expire. Whether you are employed, self-employed or unemployed, every patriotic citizen of the Philippines who is tax compliant can get a Tax Identification Number.

What are the requirements for TIN ID?

During the TIN ID application, the Bureau of Internal Revenue demands different sets of requirements depending on the working status of the applicant. Based on the BIR official website, below are the TIN ID requirements for the application documents for employees.

- BIR Form 1902

- Identification documents include a birth certificate, passport, LTO driver's license, or community tax certificate.

- Marriage contract for married women

- Passport for foreigners

With the above documents, duly follow the steps below.

- Visit the nearest BIR branch to obtain BIR Form 1902. This form is used by applicants who are earning income and non-resident citizens.

- Accurately fill the form with personal information and allow your employer also to fill in his part.

- Submit the filled BIR Form 1902 and the requirements mentioned above to the Revenue District Office. The RDO must have jurisdiction over the area where your employer's office is located.

How to get a TIN ID for unemployed

Source: UGC

Acquiring a Tax Identification Number in the Philippines as unemployed is now straightforward. Under Executive Order No. 98, unemployed citizens can also apply for the Tax Identification Number.

The document is a mandatory requirement for the following government-related transactions.

- Applying for a passport from the Department of Foreigner Affairs (DFA).

- Driving license from the Land Transportation Office (LTO).

Executive Order No. 98 prompted the BIR to allow persons required to provide the card in their transaction with the government to secure the document. The requirements for the unemployed are as follows.

- BIR Form 1904

- Identification documents such as birth certificates, National IDs or passport

- Marriage certificate for married women

- Passport for foreigners

The application process is simple and easy. Follow the steps below.

- Get the BIR Form 1904 from the closest BIR branch.

- Duly fill out the form and make a copy for your file.

- Attach a copy of your identification document, such as a birth certificate.

- Submit a duly filled BIR 1904 Form with the above requirements to the RDO with jurisdiction over your residence.

- Inquire when you can receive the identification card and wait for the issuance.

How to apply for TIN ID card online

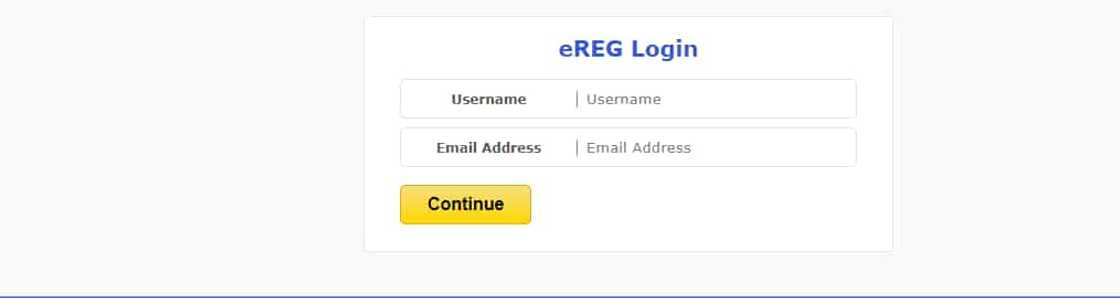

With the Internet, most government operations have been simplified and easily accessible to citizens. One such service is TIN ID online registration. The process of how to get TIN number online is quick and convenient for the applicants.

Through the web application system tagged BIR eReg, citizens of the Philippines can access the online application for the document. You can apply without physically appearing at the Bureau of Internal Revenue branch offices.

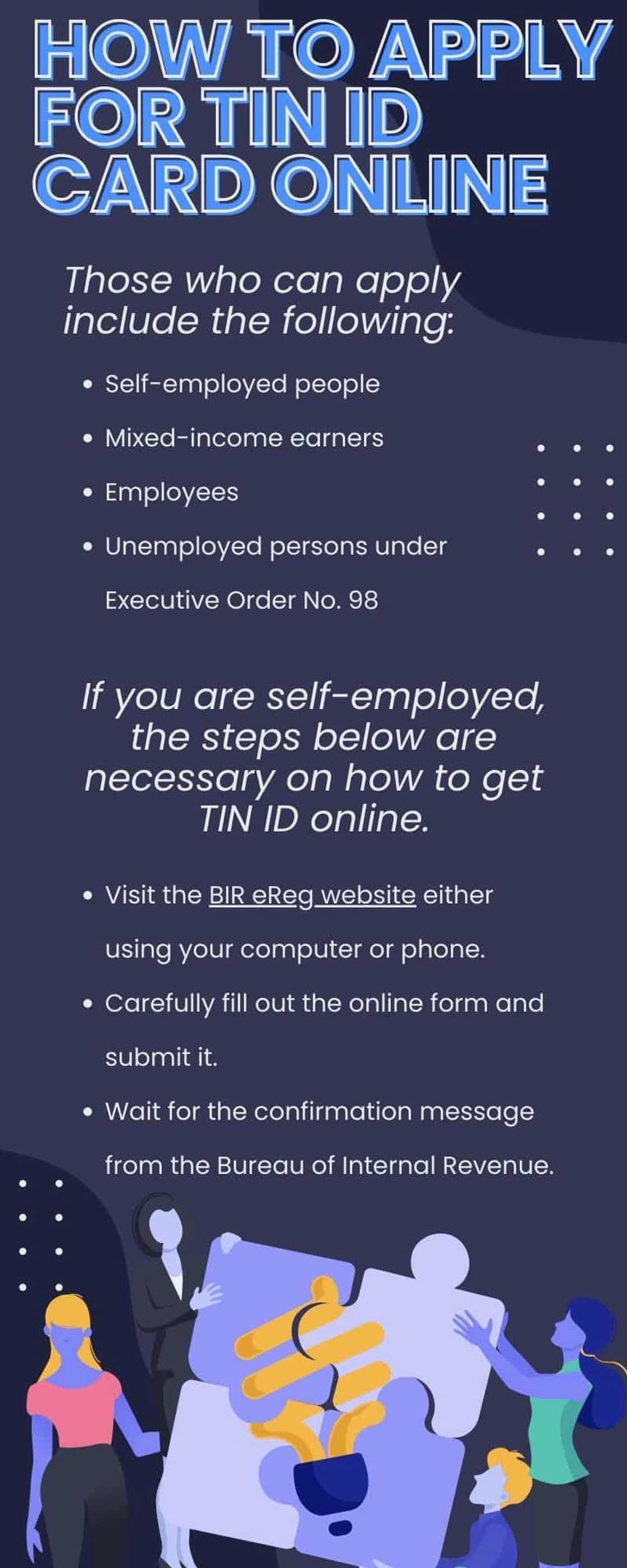

Who can apply for Tax Identification Number online? Those who can apply include the following:

- Self-employed people

- Mixed-income earners

- Employees

- Unemployed persons under Executive Order No. 98

If you are self-employed, the steps below are necessary on how to get TIN ID online.

Source: UGC

- Visit the BIR eReg website either using your computer or phone.

- Carefully fill out the online form and submit it.

- Wait for the confirmation message from the Bureau of Internal Revenue.

How to get TIN ID if lost

Did you know that you can have a replacement if your card is lost or damaged? The replacement exercise will cost you a processing fee of P100. The following are the requirements needed:

- BIR Form 1905

- BIR Form 0605 (Payment form)

- Notarized Affidavit of Loss (Costs between P150 to P300)

- Marriage certificate if married

Below are steps you can follow on how to get a TIN ID card when it is lost.

- Visit the RDO where you received your document.

- Fill in the BIR Form 1905.

- Submit the duly filled form together with the other requirement to the COR update window.

- Fill out the BIR Form 0605 and submit it to the payment window for verification.

- Proceed to any RDO's authorized bank agent to pay the replacement fee. Upon payment, you will get issued a receipt and a machine-validated BIR Form 0605.

- Submit the receipt and machine-validated BIR Form 0605 to the COR update window at the RDO.

- Get your TIN ID. In some instances, you can receive the document on the same day. Normally, applying for a replacement can take you at least two hours.

How to verify TIN number

The Bureau of Internal Revenue launched the Mobile Taxpayer Identification Number (TIN) Verifier app to provide taxpayers with a convenient way to recover or verify their TINs.

Therefore, instead of going to the Bureau of Internal Revenue district offices, Filipinos can receive real-time responses to their TIN-related inquiries at the touch of their fingertips.

The BIR TIN verification serves two purposes. They include:

- TIN inquiry

- TIN validation

How to get TIN ID with existing Tax Identification Number

Source: UGC

Do you know how to get TIN ID if you already have the number? All you need to do is go directly to the Revenue District Office, where you are registered and apply for the card. The applicant must present at least a valid government ID to be issued the card.

Is it legit to get TIN ID online?

Yes, a TIN ID can be obtained online via the Bureau of Internal Revenue's (BIR) online registration system. Online registration enables quick and easy registration from any location with an internet connection.

Can you get TIN ID immediately?

The application process for a TIN ID card can take up to three working days since you must submit the required documentation and wait for the BIR to process your application.

How much is the fee for TIN ID?

Applying for a TIN ID is free. However, you may be required to pay some fee if you replace your lost ID.

If you have been looking for a TIN ID, the procedures involved are simple and can be done by anyone wanting it. The card is important for government-related transactions, whether employed, self-employed or unemployed. Depending on your employment status, the step of securing the document may vary; however, they are all straightforward and convenient.

Kami.com.ph also published an article on NBI clearance renewal. The demand for the NBI clearance document is high in almost all public sectors. Therefore, there is a need for you to possess an updated document.

Although the process is quite simple, many people still find it difficult to renew this document. Fortunately, there are various options for doing it; depending on where you are and other factors, you could opt for any.

Source: KAMI.com.gh