How to check Pag IBIG contribution: online verification and ID requirements

The Home Development Mutual Fund, popularly known as the Pag-IBIG Fund, has helped many Filipinos apply for flexible and affordable housing loans since its inception. If you want to know how to check your Pag-IBIG contribution, the process is straightforward.

Source: UGC

Most Filipinos want to live in a home they can call their own, but some may not be aware of the resources provided by the government to help realize this. One of the most valuable yet overlooked and misunderstood is the Pag IBIG Fund.

Pag IBIG contribution

The government founded the Pag-IBIG Fund to give Filipinos an opportunity to own a decent home. Active members can apply for a loan of up to PHP6 million, which they can use to finance the home of their dreams.

This loan, of course, is subject to the loaner's compliance with the requirements. If you need to check your Pag-IBIG contribution, you will have to use the Pag-IBIG online verification of contribution to access your payment history.

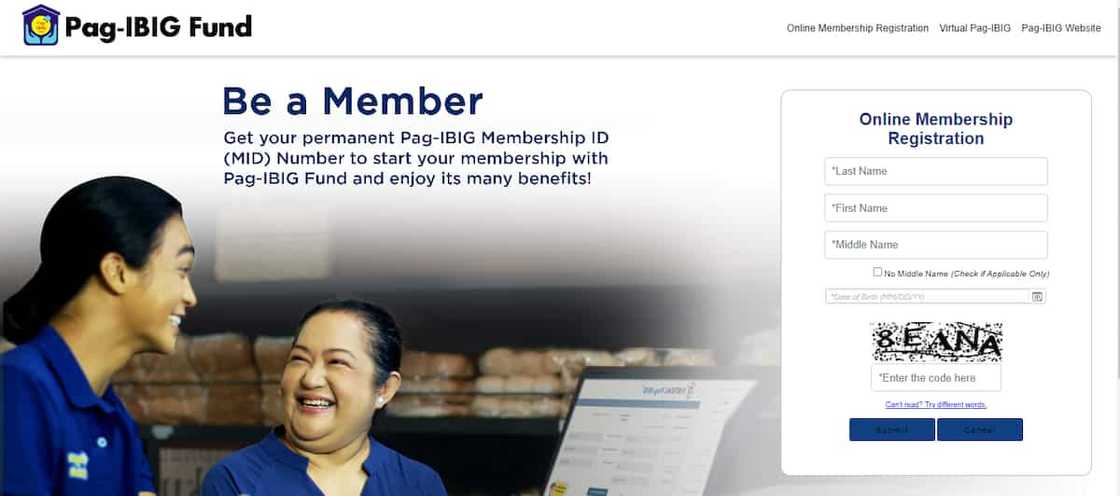

How to apply for Pag IBIG

Source: UGC

Besides being an instrumental savings program that can benefit every member in the long run, Pag IBIG is also a standard job requirement in the Philippines.

As a result, many new job hunters are seeking information on Pag IBIG registration. What are the mandatory steps that one ought to follow to apply?

- To apply as a new member, visit the official Pag IBIG website.

- Scroll down the page and under "Quick Links" click the "Be a Member" link.

- You will be redirected to the membership registration page.

- Fill out your last name, first name, middle name and birthday, answer the verification box, and click "Submit".

- Proceed to fill out the form which requires precise information about your family, accurate address, and employment history. You will also need to enter contact information, such as your phone number and email address.

- After double-checking the accuracy of the form, you can click "Submit Registration".

- At the bottom of the "Successful Registration" page, you will see the "Print MDF" button. Depending on the settings of your computer, a PDF file should appear or be downloaded to your hard drive.

- This file is your Pag IBIG form (also called the Members Data Form or MDF) that you can present to your employer. It contains your registration tracking number, also sent to your mobile phone.

Note: Make sure to double-check the information you are providing on the form. Inaccurate information may cause problems in applying for a loan in the future. Furthermore, any changes you wish to make to your information must be personally requested at the nearest Pag-IBIG branch.

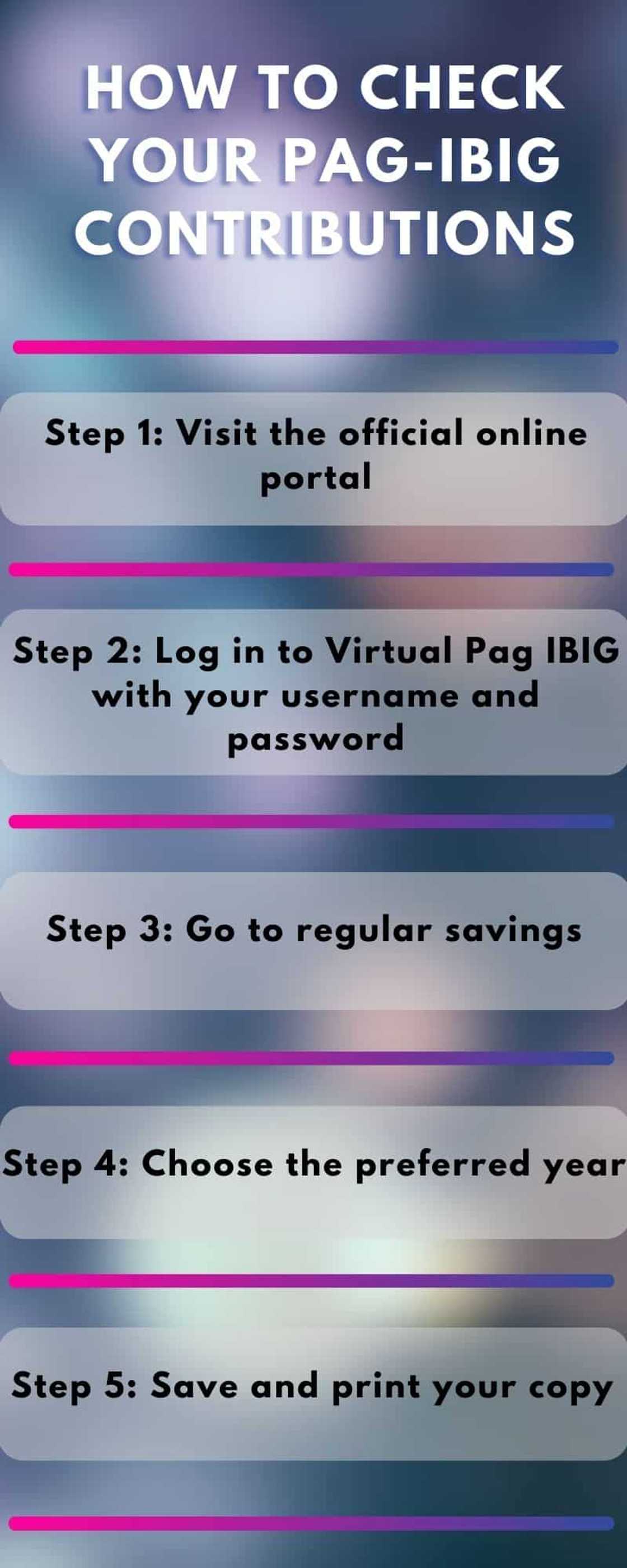

How to check your Pag-IBIG contributions

Do you want to know how to check Pag IBIG contribution online? Once you have been registered and started making contributions, it is integral to check your status.

You should regularly check your data to learn if the contributed amount is enough to apply for a home or a calamity loan. You can check all your details online or manually using your Pag IBIG login details.

Step 1: Visit the official online portal

The Pag IBIG online services are easily accessible via their website. Open the website and click on the "For Members" tab. You will get a pop-up page about the data privacy statement and policy. Mark the empty box and click "Proceed".

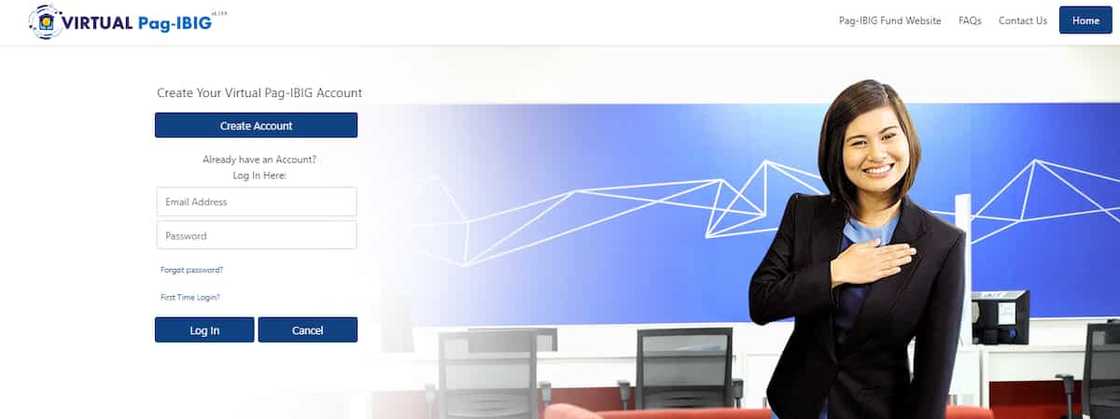

Step 2: Log in to virtual Pag IBIG with your username and password

This is another essential section of the Pag IBIG website that will allow you to access your account using your login details. You will notice a login button at the bottom left of your screen.

Source: UGC

Click the button and hit "Continue" to go to the login section. Type your email address and password in the appropriate fields and click "Log In."

Step 3: Go to regular savings

After logging in, you will be directed to a different page possessing various Pag IBIG fund products. They include:

- Regular Savings

- MP2 Savings

- Housing loans

- Calamity loans

- Loyalty Card Plus

- Multipurpose loans

Since you are interested in mandatory contributions, click the "Regular savings "(mandatory contributions) link. You will get results showing your initial remittance date, last remittance date, total share, total contributions in months, savings and dividends.

Step 4: Choose the preferred year

What year do you want to check your contributions? Input the range and ascertain that it is within your initial and last remittance date. Once you have selected everything appropriately, hit the "View contribution" tab.

Step 5: Save and print your copy

The best way of preserving your contribution records is through printing. Although it is optional, it is an excellent way of keeping tabs. If you cannot print, take a screenshot of the page, which you can print later.

Note: Even if your payroll records reflect these remittances, it is not a satisfactory assurance that your employer pays your premiums in full. The only way to find factual data is by checking the records yourself.

How to get Pag IBIG registration tracking number after registration

The Pag IBIG registration tracking number (RTN) is located at the upper left of your Member's Data Form (MDF). It is also sent to the mobile number you provided during the registration.

How to check Pag IBIG number (Pag-IBIG MID Number)

Source: UGC

You can complete the Pag IBIG number verification two days after registration. To do this, you should send a text message in a certain format.

IDSTAT<space>[RTN]<space>< MM/DD/YYYY>, for example, ID STAT 123456789123 01/01/2000. Send to 09178884363 (Globe and TM) or 0918 888 4363 (Smart and Talk n' Text)

This is only for newly registered users. Existing members who lost their Pag-IBIG ID number will have to request it at the nearest Pag-IBIG branch or call the official Pag IBIG hotline (724-4244).

Alternatively, one can send a message to Pag-IBIG's official Facebook page or inquire via email at contactus@pagibigfund.gov.ph.

How to get Pag IBIG ID or Loyalty Card

There is no way to apply for a Pag-IBIG ID (also called the Loyalty Card) online. However, you should download the application form online and fill it out. When ready, go to your nearest Pag-IBIG branch. Have your Pag-IBIG number ready and P125 for the card fee.

What is Pag IBIG acquired asset?

Monthly contributions to Pag-IBIG paid by its members are typically allocated to build a borrower's first home. If the borrower misses consecutive arranged payments, they are considered to have defaulted on the loan.

According to the agreement and terms, their property can be foreclosed. Although Pag-IBIG allows their borrowers to buy back their seized property, they can offer this option to any who may rent and occupy their assets while the loan is still unpaid.

If the borrower or tenants cannot purchase the property, Pag-IBIG will offer it to new buyers through public bidding. This is to recover the loss from the unpaid loan and potentially generate income for the fund.

Requirements for a Pag IBIG loan

The Pag-IBIG Fund housing loan program is available to all active Pag-IBIG Fund members who have satisfied the following requirements:

- At least 24 monthly savings lump sum payment of the required 24 months of savings is allowed.

- Applicant must not be more than 65 years old.

- Passed satisfactory background/credit and employment/business checks of Pag-IBIG Fund.

- Has no outstanding Pag-IBIG Fund Short-Term Loan (STL) in arrears at the time of loan application;

- Has no Pag-IBIG Fund Housing Loan that was foreclosed, cancelled, bought back due to default, or subjected to decision en pago. If with an existing Pag-IBIG Fund Housing Loan account, either as principal borrower or co-borrower, it must be updated.

When applying, prepare to pay the processing fee of PHP1000 and bring a fully completed Housing Loan Application Form with a recent ID photo. The applicant also needs to provide recent proof of income, such as their pay slip from the last three months and a photocopy of any valid ID (front and back).

After securing all the requirements, you can proceed to the nearest Pag-IBIG branch in your location, where their staff will assist you.

What is Pag IBIG Fund?

You are likely wondering what the initials IBIG stand for. Philippines citizens ordinarily see the mandatory contributions deducted from their payroll as part of a national savings program. The initials have an interesting meaning, and they stand for:

- Individuals (you)

- Banks

- Industry, and

- Government

Pag-IBIG keeps your savings until you are 65 years old, and it is your emergency fund in times of need.

Now you know how to check Pag IBIG contribution. It is always good to know about the services provided by the government if you are an adult looking to secure your home. Also, regularly check your contribution and do a Pag-IBIG online verification upon application to certify the accuracy of your data.

Have you been trying to figure out how to get UMID (Unified Multipurpose ID)? Kami.com.ph featured an interesting piece about one of the most powerful identity documents in the Philippines.

Anyone interested in the document need to be qualified, as the government is strict about eligibility. Also, applicants ought to process their applications in person, as proxies are not allowed.

Source: KAMI.com.gh