BIR Form 1905: how to fill up in 2023? Sample, latest version, requirements

A Filipino employee or business owner needs BIR Form 1905 when updating their tax registration details. Filling out the document allows you to update, correct, or cancel your tax registration information. After that, the taxpayer must file their BIR Form 1905 at the Revenue District Office with jurisdiction over them.

Source: UGC

You should update your tax registration information to ensure it aligns with the taxing jurisdiction and the income subject to withholding tax. You can discover what a BIR 1905 Form entails, its purpose, and other details below.

What is BIR 1905 Form?

A BIR 1905 Form is an application document from the Bureau of Internal Revenue. It is required for updating, correcting, or canceling a taxpayer's registration information.

What is the use of BIR Form 1905??

All taxpayers, whether individuals or corporate, must fill out the BIR registration form if they intend to update or change any of their tax registration details. Below are some of the 1905 BIR Form's purposes, but its importance is not limited to these:

- The form is used to transfer a business within the same RDO (Revenue District Office).

- You need the document to cancel a business registration after shutting it down.

- The form is used to transfer a business to another district.

- You use the form to change your tax registration.

- The document is needed when replacing a lost TIN Card or Certificate of Registration.

When should you fill out the BIR 1905 form?

You must fill out a BIR 1905 form whenever your tax registration details change. The BIR 1905 form should be filed with any RDO branch or head office with jurisdiction over the taxpayer.

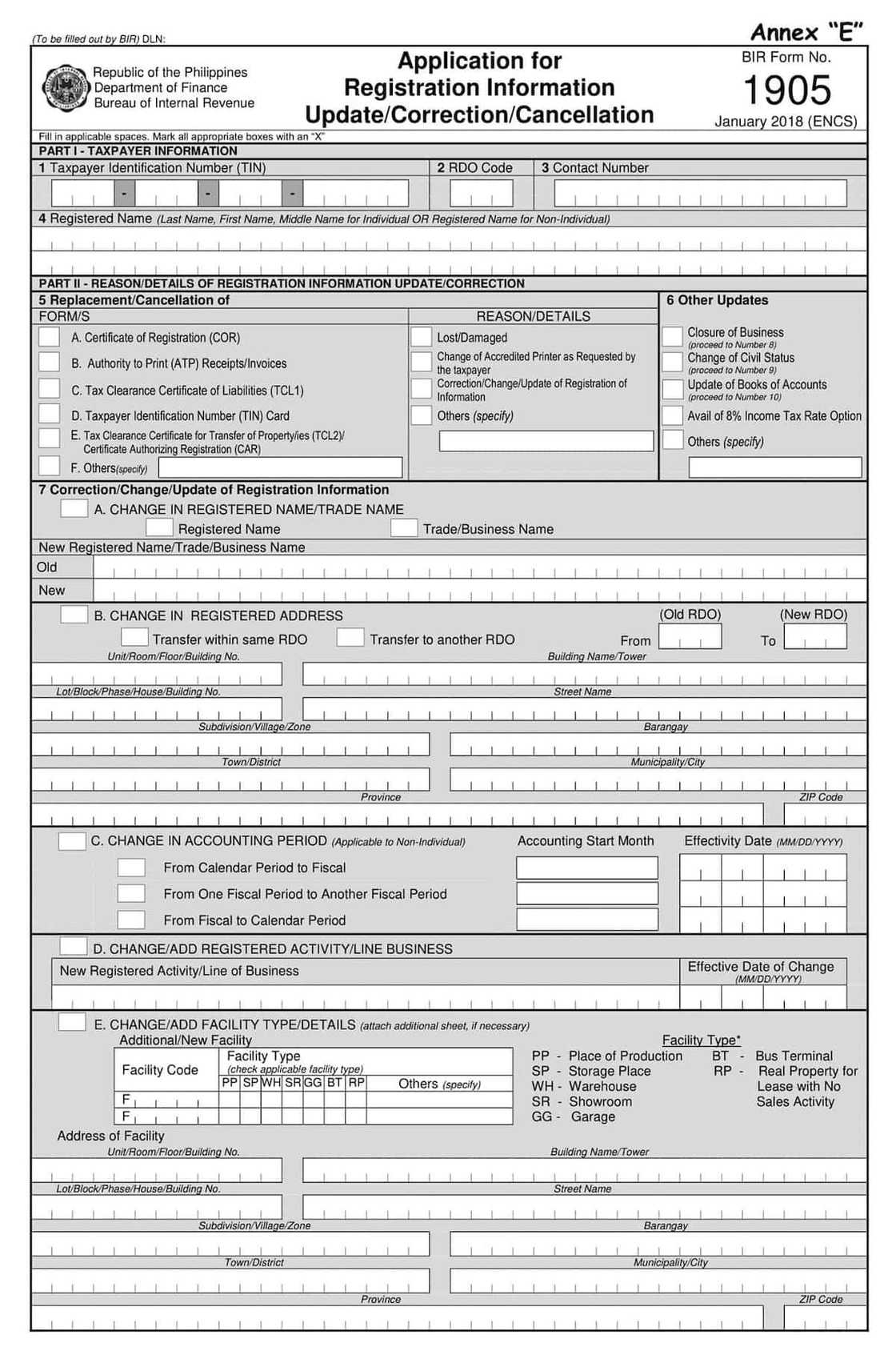

BIR Form 1905 sample

A BIR Form 1905 contains two pages. You fill in your taxpayer information in the first section and provide details about your intention of filling out the form in the second section.

For example, if you are filling out a BIR Form 1905 to cancel or replace a document, you will select the document and reasons for updating those details in the first section of your BIR Form 1905.

You can also provide other relevant information regarding the changes or corrections in the first section. You provide the documentary requirements for each purpose on the second page of the BIR Form 1905.

Source: UGC

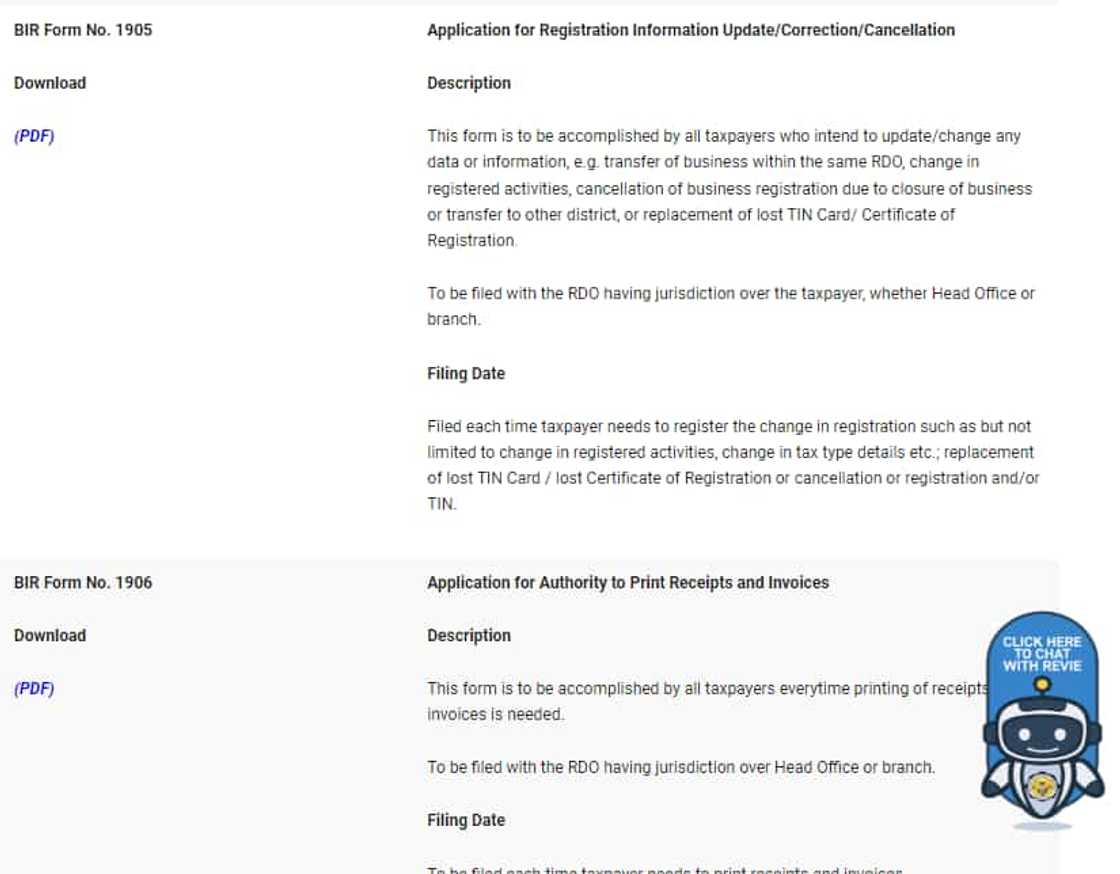

How to get your 1905 BIR Form?

You can download the BIR Form 1905 latest version online, edit it, then print it. All BIR downloadable forms are in pdf format on the BIR website. You should always inquire about the correct BIR Forms to download before embarking on the process. Otherwise, you must return to the website to download the right one.

Source: UGC

How to fill up BIR form 1905

The BIR form is a crucial document that must be filled with precision. It has different sections that have to be filled with the relevant information. Here are the simple steps to follow:

- Download BIR Form 1905 pdf from the official BIR website.

- Fill in Part I (Taxpayer Information) with the requested details. The information provided should be as per the one registered with the bureau.

- Go to Part II (Reason/Details of Registration information Update/Correction) and fill in as requested.

- Proceed to other relevant fields in accordance with the purpose of updating, correcting, or canceling tax registration.

- Finish with Number 12 (Declaration) by providing your full name and official signature.

How do I submit a BIR form?

When you are done, book an appointment on the BIR eAppointment System. Choose a date and time that works best for you. On the scheduled date, present your filled out 1905 BIR Form latest version to the Revenue District Office where you are registered or any Tax Filing Center established by the BIR in person. Ensure you attach the relevant documents to your BIR form.

Is there BIR form 1905 online registration?

You can only download and edit the form but cannot submit the filled form online. You should take it and the relevant documents to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR in person. You should book an appointment on the BIR eAppointment System.

Since the requirements for filing a BIR Form 1905 vary depending on the purpose, inquire how to fill the document at the nearest RDO branch. or www.bir.gov.ph.

What is the RDO code for BIR?

The RDO code is the location number of the Revenue District Office, which keeps records of taxpayers who fall under their jurisdiction. The code is at the upper right of your BIR form. If you previously filed for transfer, you can still find your updated RDO code on your BIR Form 1905 at the upper right of the form.

What is BIR 1905 for RDO transfer?

A BIR 1905 for RDO transfer is the form you fill out to apply to transfer or update registration from one RDO to another. To transfer/update registration from one RDO to another, follow these steps:

- Fill out the two copies of the BIR Form 1905 (application for registration update), including where your TIN number is currently registered.

- Please indicate the new RDO where you are requesting to be transferred.

- Take the BIR Form 1905 to your old RDO.

- The process should be done in about a week, and your TIN should now be registered to your new RDO.

What is BIR 1905 for pre-employment requirements?

You use your BIR Form 1905 to transfer your records from your previous Revenue District Office (RDO) to the 24/7 Customer's RDO. To do this, you should follow these steps:

- Ask your previous employer or visit the BIR website to know where your RDO is.

- If your RDO is outside the areas mentioned above, you should process Form 1905 on your own. Complete the form and have it stamped in your previous RDO. Forward the stamped copy on your Day 1.

- If your RDO is within Makati, Taguig, Parañaque, Ortigas, or Cubao, fill out the form and submit it on Day 1. Please complete the following fields:

- Write your Taxpayer Identification Number.

- Write your current RDO. (You may call BIR Customer Service Hotline 981-7000 or your previous employer to inquire where your record is currently registered.)

- Taxpayer’s name (your name).

- Tick Part II (Letter E), then proceed to item 4E.

- Tick box 1 (Transfer of Home RDO) if your RDO is not 50.

- Mark box 2 (Transfer within same RDO) if your RDO is still 50 despite changing employer.

- Write your signature over the printed name above the heading Taxpayer/Authorized Agent.

What is the email address of BIR?

Taxpayers with tax concerns and queries can contact the Customer Assistance Division (formerly BIR Contact Center) using the following channels:

- Hotline number: 8538-3200

- Email: contact_us@bir.gov.ph.

The BIR 1905 Form is an important document that affirms a change in a taxpayer’s jurisdiction, thereby enabling the Filipino government to account for its taxpayers. Filling the document is simple, and now that you have all the details about it and how to fill it, you can easily do it next time the need arises.

Kami.com.ph explained the process Filipino taxpayers must follow to get their Tax Identification Number. The document is used as proof of membership with the Bureau of Internal Revenue (BIR) and as a valid ID.

TIN is issued by the Internal Revenue Service (IRS), and the authority uses it to administer tax laws. Since the document is crucial and every eligible Filipino taxpayer needs it, you must familiarize yourself with the TIN application process.

Source: KAMI.com.gh