1902 form: what is it, how to get and fill up (2020)

Getting your first job gives you the most exhilarating feeling ever. On the other hand, after getting that job, there are a lot of things you are required to procure, such as the Bureau of Internal Revenue or BIR 1902 form. One must comply with this because the document is a part of an employee's pre-employment requirement.

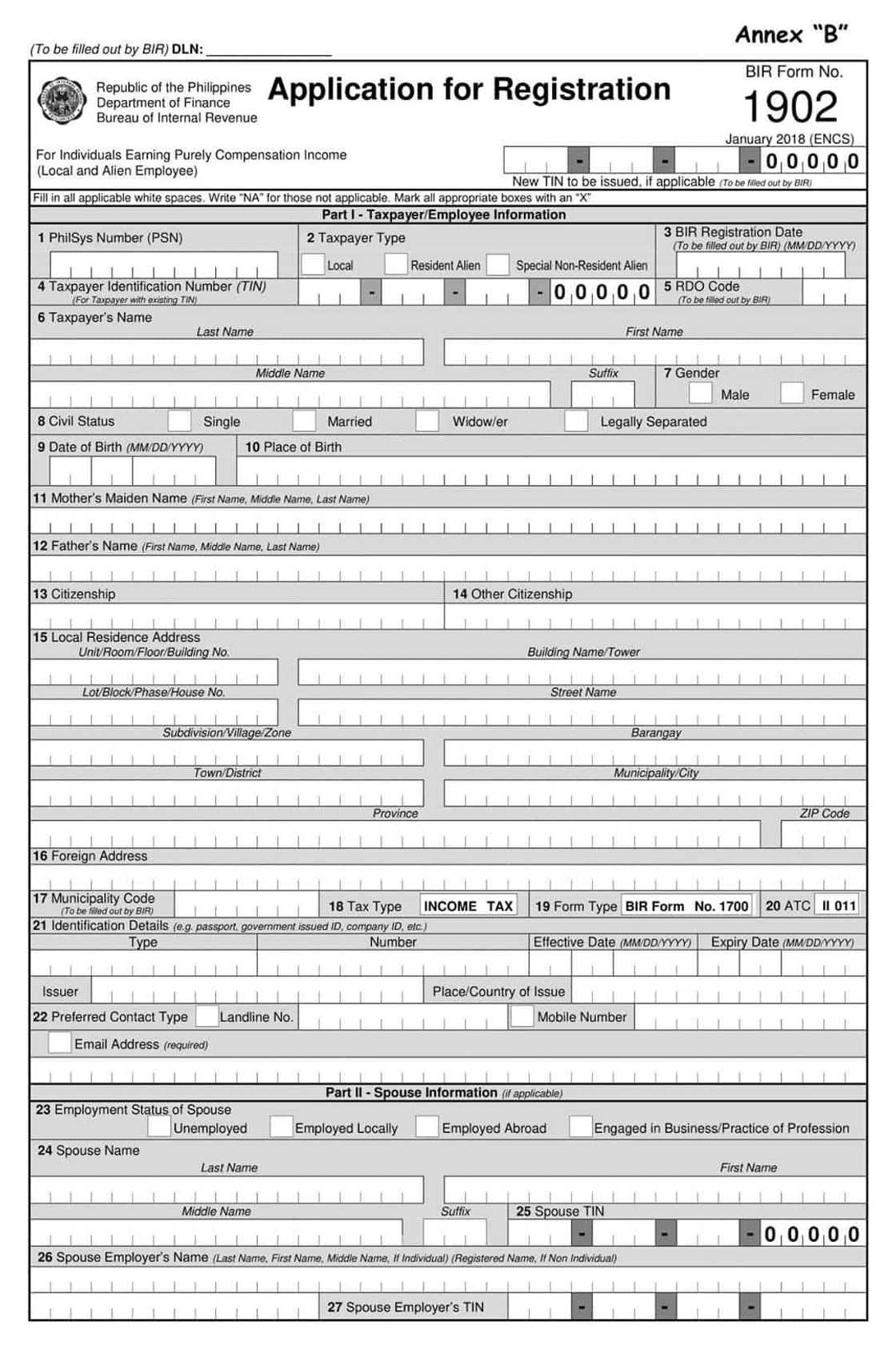

Source: Facebook

Are you excited to take the first step for your new employment? We have gathered the necessary information that you need to know about the 1902 form.

What is BIR form 1902?

The Bureau of Internal Revenue (BIR) is an attached agency of the Department of Finance. It is tasked to assess and collect all national internal revenue taxes, fees, and charges. Its duty is to enforce all forfeitures, penalties, and fines.

The agency requires all employers and employees to accomplish specific forms like the 1902 application. The paper is to be filed with the RDO having jurisdiction over the taxpayer's residence or place of employment.

What is the use of BIR form 1902?

The BIR 1902 form is used to record new employees in the Philippines. An employee should accomplish this requirement whether she is a resident citizen or non-resident earning purely compensation income. This requirement must be filed within ten days of the start of employment.

Source: Facebook

How to get BIR form 1902

To get a copy, one can visit the BIR website as they already provided a PDF file of the 1902 form, which you can download and print. After filling-up, submit it to the revenue district office.

How to fill up BIR form 1902

Here is how you should fill the PDF file you downloaded from the BIR website:

- Choose the taxpayer type by checking the box, whether a local employee or a residential alien employee.

- It is vital to fill up the date of the registration box.

- Regarding the RDO code, it is the BIR's responsibility to fill it out.

- Fill up the form with the rest of the needed information, such as your gender, name, age, address, and telephone number.

- It is also essential for you to fill up the spouse and dependent children's information box.

- After filling up all the needed information, you should not forget to sign it with your signature.

BIR 1902 form requirements

Here are the requirements when filing:

- Two printed copies of the 1902 form, filled-up by the employee and the employer. If the employer is not available, it can be accomplished by an authorized representative, such as the company’s human resource officer.

- If the applicant is a local employee, he/she will need a birth certificate, a community tax certificate, and a valid identification card, like PRC license, passport, or the likes, showing the applicant’s name, address, and date of birth.

- If the applicant is a local employee but is married, he/she will need the same requirement as that of a local employee, and a marriage certificate as well.

- If the applicant is a foreign employee, he/she need to provide his/her passport and working permit. If a working permit is not possible, he/she should submit a photocopy of duly received Application for Alien.

- All employees are required to get Employment Permit (AEP) from the Department of Labor and Employment (DOLE).

Note: The BIR does not require or charge any fee for registration.

BIR’s 1902 form is a significant one to accomplish, especially when you are just starting in your employment. We hope that the simple steps and tips above will help you much.

READ ALSO: Cenomar requirements, meaning, expiration, where to get

Source: KAMI.com.gh