How to compute separation pay in 2023 in Philippines: DOLE, calculator, retrenchment

Parting ways for any well-established employment relationship can be unpleasant to one or both parties. However, this is bound to happen. In such an eventuality, all the parties need to know how to carry out separation pay computation as this would ensure that they separate amicably.

Source: UGC

To receive a complete package at the termination of service, an employee must be conscious of the exact amount he or she deserves from the employer. Many workers complain when they receive a lower amount than they expected. Some have even opted to go to court and ended up using more resources on their cases. Therefore, to stop all these, employees, not forgetting employers, must have a profound knowledge of the calculation methods involved.

Separation pay computation

What is separation pay? This is the amount that an employee is given for termination from duty for reasons out of his control. When an employee retires, dies, or his employment contract gets terminated, he or she ought to receive a package from the employer as compensation.

Who is entitled for separation pay? According to Article 283 of the Labor Code issued by the Department of Labour and Employment (DOLE), an employee can receive a separation salary if the following reasons caused their termination:

- Redundancy.

- Installation of labour-saving devices.

- Closing or cessation of operation of the establishment.

- Retrenchment to prevent losses.

When computing separation pay, DOLE bases it on the latest salary rate of the employee and is exempted from tax. In calculating the income, a period of six and above months is counted as a year.

How to compute separation pay

How is separation pay calculated as per dole? Calculation of separation pay may be based on the company policy and terms and conditions provided in the employment contract or collective bargaining agreement.

Company practices can also be used in the computation if they have been followed for years and have ripened into acceptable rights.

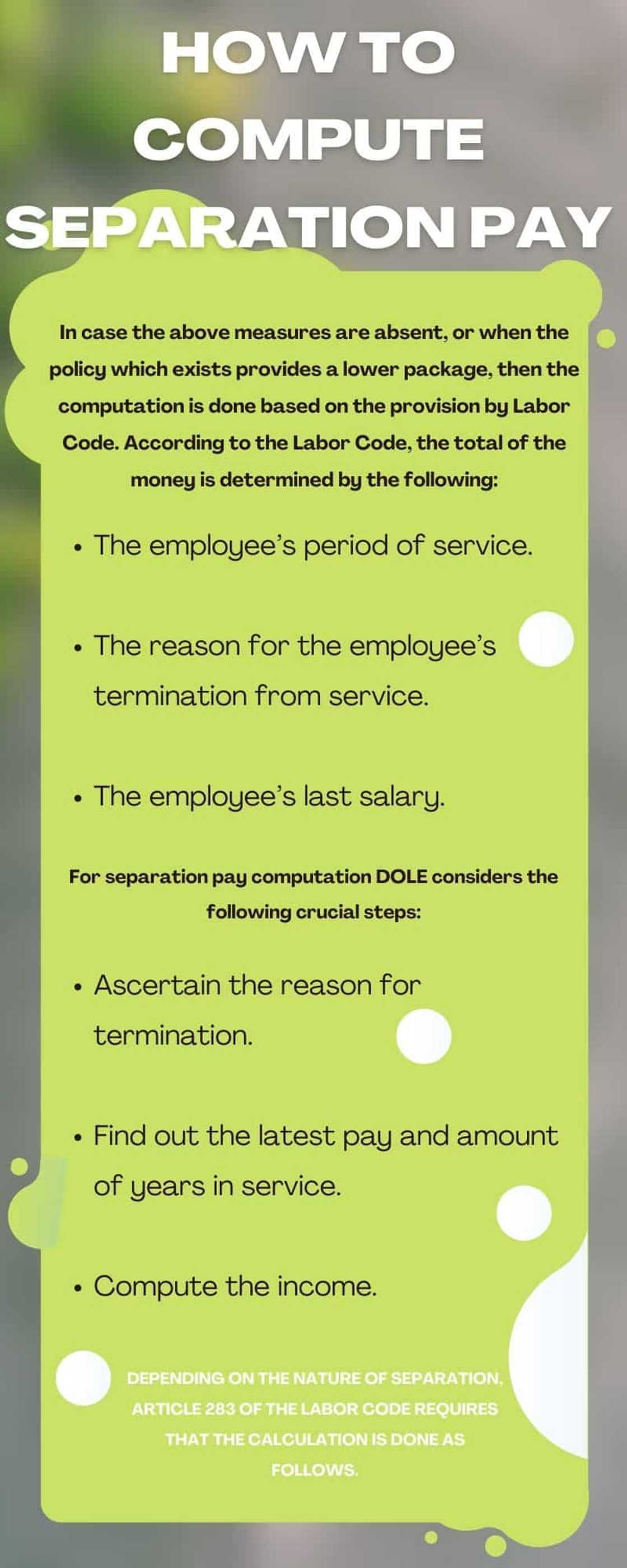

In case the above measures are absent, or when the policy which exists provides a lower package, then the computation is done based on the provision by Labor Code. According to the Labor Code, the total of the money is determined by the following:

- The employee's period of service.

- The reason for the employee's termination from service.

- The employee's last salary.

Source: UGC

In the Philippines, the pay is connected to the Labor Code. When a worker satisfies the terms mentioned above, conditions and stipulations qualify for the package.

As an employer in the Philippines, you must be familiar with the computation to avoid any illegality. A worker, on the other hand, should as well understand the calculation to avoid being conned.

For separation pay computation DOLE considers the following crucial steps:

- Ascertain the reason for termination.

- Find out the latest pay and amount of years in service.

- Compute the income.

How is separation pay calculated in the Philippines?

Depending on the nature of separation, article 283 of the Labor Code requires that the calculation is done as follows.

Redundancy or due to health reasons or installation of labour-saving devices

The cash should be equal to one month's pay for every year of service. Whichever amount is higher should be paid to the affected employee.

Source: UGC

Check out the examples below.

Example 1

If an employee earning P5000.00 p.m and who has been working in the company for 10 years gets laid off because of the above reasons, the package is computed as follows.

One-month salary = P5000.00, or

One-month pay for every year of service = P5000.00 x 10 = P50000.00

He will be paid P50000.00

Example 2

If an employee on the above salary scale has only been working for the company for only five months, the separation pay computation is as shown below.

One-month salary = P5000.00, or

One-month income for every year of service = P5000.00 x 0 = 0.00

He will be paid P5000.00

Retrenchment to prevent losses and closure of business

The affected employee is entitled to a separation pay of at least one month's salary or 1/2-month salary for every year of service, whichever amount is higher.

Below is an example to explain the concept further.

Example 1

If an employee earning P 7500.00 every month has been working for three years in a given company and gets retrenched, his separation income will be calculated as follows.

One month salary = P7500.00, or

Half month salary for every year of service = (1/2) x P7500.00 x 3 years = P11250.00

Based on the above retrenchment pay computation, the highest amount is P11250.00. Therefore, the affected worker will be paid this amount.

Example 2

If a worker earning P7500.00 every month has been working for five months and gets retrenched, the computation of separation income is as follows.

One month salary = P7500.00, or

Half month salary for every year of service = (1/2) x P7500.00 x 0 years = 0.00

The highest amount, in this case, is P7500.00, and it is the value the worker will receive.

Illegal termination

In case of illegal termination, separation pay instead of reinstatement is calculated at one month's salary for every year of service. The Philippine law requires that affected workers should receive at least one month's salary as the separation pay.

Can to get separation pay if you resign?

There are circumstances when a worker could be denied the money, for example, misconduct, incompetence, or voluntary resignation. However, depending on the company policies, collective bargaining agreement, or employment contract, some employees may be entitled to the package after voluntary departure.

How to compute separation pay for resigned employee

The computation for the separation pay for a resigned individual may vary. The simple and major calculations are done as follows:

Example:

The sum of your one-month salary plus 1 month’s salary for every 1 year of service you have completed with the company.

- Monthly salary: P30,000

- Year of service: 3 years

P30,000 + (3 x P30,000) = P120,000

Knowing more about separation pay computation is one crucial thing every worker and employer should strive to understand. The examples above will be helpful in the quest to determine the separation pay you are entitled to in case of termination.

Kami.com.ph recently published an article on how to check balance in Smart. If you are a subscriber on the prepaid service, you occasionally perform a load check to determine how many calls and text messages you can send.

Checking balance in Smart is one of the most straightforward operations for subscribers. If you are new, you may require a step-by-step guide through the process.

Source: KAMI.com.gh