How to compute SSS contribution: explaining in details

Many employees in the Philippines pay for their monthly SSS contributions, but not as many know how to compute them. Many may also be unaware of the benefits that an eligible member can enjoy. What are the advantages of the service? Do you know how to compute for SSS contribution?

Source: Instagram

Nearly every Filipino employed locally or overseas contributes monthly to the SSS or the Social Security System fund. This demographic includes those who are working for the public and private sectors. However, not everyone understands the benefits they qualify for, and most tend to overlook how they can enjoy the perks of their contributions. Knowing how to compute SSS contribution in the Philippines will leave you at a better place.

SSS or Social Security System is an insurance program mandated by the Philippine government to cover all income earners or workers in the private sector, while those in the public sector are also encouraged to be a member. Hence, a valid SSS registration is one of the requirements asked by employers in the country from their new employees.

SSS is one of the most supremely useful services readily provided by the Philippine government. Eligible members who do not miss their payments can enjoy many perks - such as compensation for maternity bills, disability benefits, burial claims for a deceased family member, retirement pension, and many more. Thus, it is very important to learn about the service.

Requirements for SSS registration as an employee

A person registering for the first time as an employee or as a voluntary member is required to secure a fully accomplished Personal Record Form (E1 Form) and present any of the following documents:

- Baptismal/birth certificate

- Driver's License

- Passport

- Professional Regulation Commission ID (PRC ID)

The document submitted must be an original or a certified true copy, together with a photocopy. Upon securing the requirements, go to the nearest SSS branch and ask for further instructions.

READ ALSO: SSS Maternity Benefit: Your guide on how to avail

How to compute SSS contribution of employee based on monthly income

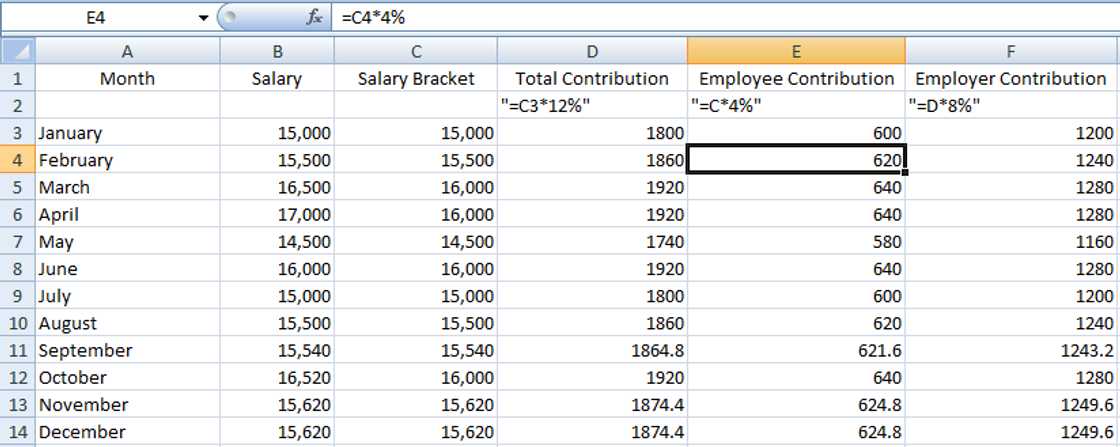

The monthly contributions required from individual members are based on their income. The current SSS contribution rate is 12% of the monthly salary credit. The salary bracket cannot exceed ₱16,000 (regardless of the member having a monthly income of more than P16,000), and this is shared by the employer (8%) and the employee (4%).

For example:

Given that the monthly salary of the concerned member is ₱40,000, then his or her contribution will only be calculated based on ₱16,000 (which is the highest monthly salary credit). The member shall then pay the amount of ₱640.00, while his or her employer will pay ₱1,280.00, for a total contribution of ₱1,920.00 per month. If you want to know how to compute SSS contribution formula, it is as follows:

For employees: (monthly salary) x (4%)

For employers: (monthly salary) x (8%)

Again, note that the monthly salary bracket for individual members will not exceed 16,000.

Freelance workers and voluntary members have to follow a similar computation, which means their contribution rate is 12% of their monthly salary credit (MSC). This is based on the monthly earnings stated when the member signed up for the service.

On the one hand, the minimum monthly salary credit is pegged at ₱5,000 for Filipino members who work abroad. On the other hand, non-working spouses’ monthly payment is based on half of the working spouse’s recently declared monthly salary. However, in no case shall the non-working spouses' contribution be lower than ₱1,000.

For your reference, how to compute SSS contribution table can be found on the official website. This table will help you learn how to compute SSS contribution 2019.

How to compute SSS contribution penalty

Registered members should not miss any of their monthly payments towards their SSS account. Be that as it may, missed payments will not deactivate or nullify your active membership status.

Upon registering as an SSS member, an individual becomes indefinitely covered even if they miss their monthly payments. There are no penalties served for individual members who fail to pay their contribution for an extended period.

However, note that SSS prohibits members from making retroactive payments in order to qualify for a loan or a benefit, such as sickness benefits and salary loans. Members are only allowed to pay for the succeeding months or in advance, but not for the months they missed their payments. If you want to know how to compute SSS contribution with absences, look no further because your contributions will always be based on your basic salary regardless of your absences.

How to compute SSS contribution in Excel

Below is an Excel table sample showing how to utilize the software to keep track of your SSS contributions easily. To emulate the table, simply create columns for the month of your salary, the salary bracket where your contribution will be based on, and use the formulas as shown. Use the fill feature to fill the rest of the columns automatically.

Source: Original

*This table is only an example to use as a reference. The computation may vary depending on your membership type.

There is no need to know how to compute SSS contribution per day. The monthly contributions are computed based on your salary alone.

Knowing the workarounds of the service can bring very useful benefits when an unexpected need arises. Unable to go to work due to an illness? Had to take a leave for maternity reasons? Became permanently disabled? SSS will have you covered like a security blanket.

Now you know how to compute for SSS contribution. Go ahead and became a responsible adult.

READ ALSO: Duterte signs SSS law that gives at least P10,000 monthly unemployment insurance

Source: KAMI.com.gh